Trillions in Options Expire as Markets Brace for a Major Witching Day

A record $7.1 trillion options expiration is expected to lift market volatility, with inflation data and Nvidia export policy shaping investor sentiment.

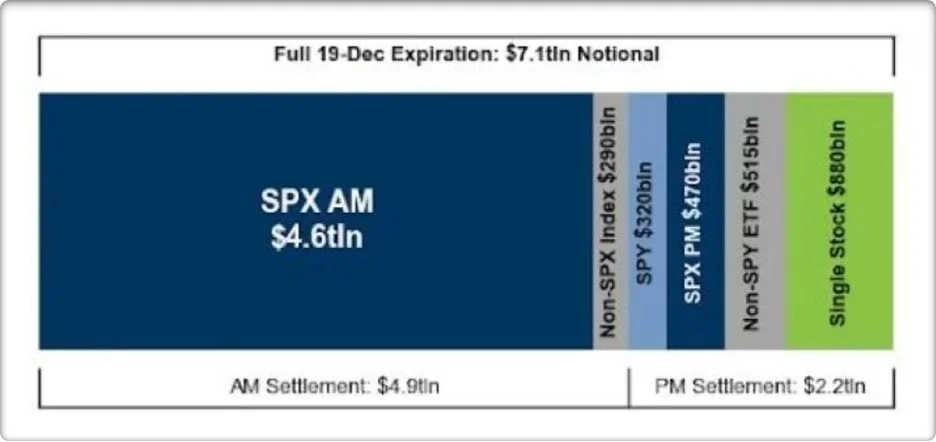

A record-breaking options expiration is set to unfold today, with contracts linked to roughly $7.1 trillion in open interest reaching maturity. Sessions of this scale are commonly referred to as Witching Days — periods when multiple classes of equity and index derivatives expire simultaneously, often triggering sharp intraday swings.

Market participants expect heightened volatility toward the close, as hedges are unwound and positioning is recalibrated. Liquidity typically thins during the final hours of trading, amplifying price reactions even to modest order flows.

Inflation Data Remains a Key Anchor

Despite the technical pressure from derivatives expiration, fundamental factors remain the primary driver of intraday direction. Recent U.S. consumer inflation data continues to support a constructive narrative, reinforcing expectations that price pressures are cooling without materially undermining economic momentum.

From a broader perspective, these data points have helped stabilise risk sentiment — even as positioning dynamics inject short-term noise into price action (as historical cycles often show).

Nvidia Export Policy in Focus

Investors are also closely watching developments around U.S. export restrictions on advanced AI chips, particularly Nvidia’s H200 accelerators destined for China.

According to industry sources, the review process involves the U.S. Department of Commerce, State Department, Department of Energy, and the Pentagon. Discussions reportedly reflect a split between policymakers advocating stricter controls and those arguing that targeted exports do not pose a material threat to U.S. technological leadership.

Any shift in policy could have broader implications for the semiconductor sector and for Nvidia’s medium-term revenue outlook, keeping the stock firmly in focus during today’s session.

Market Outlook

U.S. equity futures are trading higher ahead of the open, pointing to a positive risk balance despite the expected volatility. The overall setup suggests that directional moves will be shaped more by macro and policy signals than by the expiration itself.

In this environment, the S&P 500 is expected to trade within a 6735–6840 range, with volatility likely to rise into the final hours of the session before conditions normalise.

Daniel Brooks

Daniel Brooks