Every Major Bank Expects S&P 500 Growth in 2026 — A Warning Sign?

Wall Street strategists unanimously expect the S&P 500 to rise in 2026, with targets clustered near record highs — raising concerns about growing market complacency.

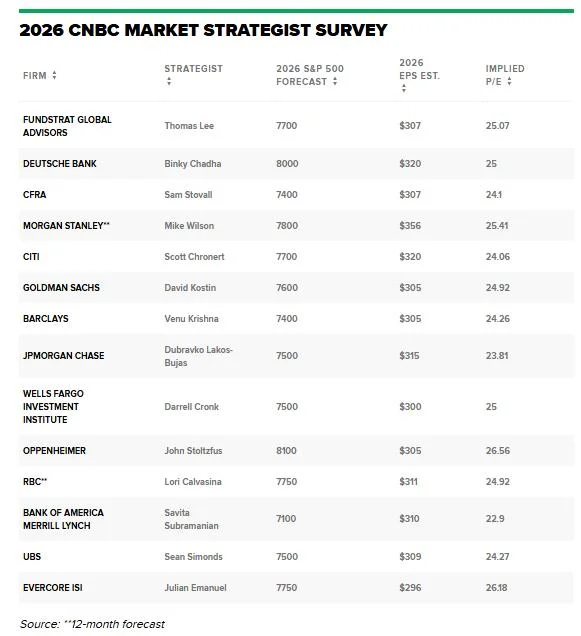

Wall Street strategists are entering 2026 with rare unanimity. According to a survey compiled by CNBC, none of the major investment banks and research firms forecast a decline in the S&P 500 next year.

The projections, which span institutions including Goldman Sachs, JPMorgan, Morgan Stanley and Bank of America, show index targets largely concentrated between 7,100 and 8,100 points. Several firms expect the S&P 500 to trade near, or above, fresh record levels by the end of 2026.

Consensus optimism across major banks

Among the most bullish forecasts, Oppenheimer projects the S&P 500 at 8,100, while Deutsche Bank and Morgan Stanley see the index approaching the 8,000 level. Even the most conservative estimates still imply gains relative to current levels.

Notably, the survey also reflects elevated valuation assumptions. Implied price-to-earnings ratios in the forecasts generally sit in the mid-20s, signalling expectations of strong earnings growth and sustained investor risk appetite.

No bearish scenarios on the table

What stands out is not just optimism, but the absence of downside scenarios. None of the surveyed strategists outline a base case involving a market drawdown in 2026 — an unusual dynamic by historical standards.

Markets rarely move in a straight line. Periods of broad consensus have often preceded higher volatility.

From an editorial perspective, the significance lies in the balance of risks. When expectations become tightly aligned, markets can grow vulnerable to unexpected shocks — whether from earnings disappointments, tighter financial conditions, or geopolitical events (as historical cycles often show).

Why portfolio protection still matters

While consensus forecasts point higher, investors are increasingly reminded that optimism alone does not eliminate risk. Elevated valuations leave less margin for error, making portfolio diversification and downside protection especially relevant as 2026 approaches.

For now, Wall Street remains firmly in bullish territory. The question is not whether expectations are high — but how markets react if reality diverges from them.

Olivia Carter

Olivia Carter