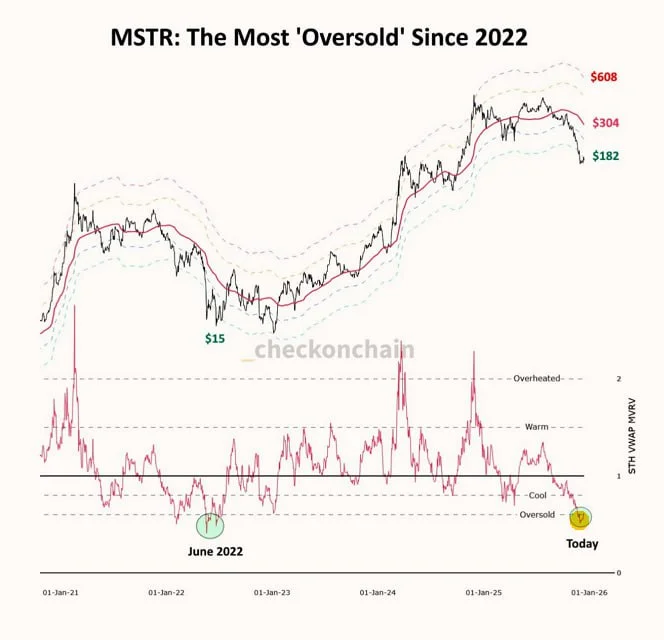

MicroStrategy Stock Hits “Most Oversold” Levels Since 2022

MicroStrategy shares have fallen into their most oversold condition since 2022, according to checkonchain and momentum metrics, raising questions about a potential rebound.

MicroStrategy (MSTR) has moved into its deepest oversold condition since 2022, according to new data from Checkonchain. The short-term holder VWAP deviation has dropped into the “oversold” zone, a level last seen during the June 2022 capitulation.

The signal appears at a moment when the company’s exposure to Bitcoin is larger than ever. As of December 7, MicroStrategy holds 660,624 BTC — roughly 3% of Bitcoin’s total supply. Since 2020 the firm has spent approximately $43.35 billion accumulating BTC at an average purchase price of $74,696 per coin.

MicroStrategy remains the largest corporate holder of Bitcoin in the world. The business model introduced by founder Michael Saylor is straightforward but aggressive: acquire BTC using borrowed capital through convertible notes, secured debt, and ongoing equity issuance.

Once again, investors are recalibrating expectations. The stock’s decline from the upper band near $600 toward the $180–200 region has pushed momentum to extreme levels, historically associated with temporary market bottoms.

Analysts note that extreme compression in momentum often precedes sharp volatility — although direction is not guaranteed. With MicroStrategy’s leverage-enhanced Bitcoin strategy, market sensitivity becomes even more pronounced.

Whether today’s oversold reading attracts dip-buyers — as it did in previous cycles — will depend largely on Bitcoin’s trajectory and the market’s confidence in MicroStrategy’s long-term leveraged accumulation strategy.

Daniel Brooks

Daniel Brooks