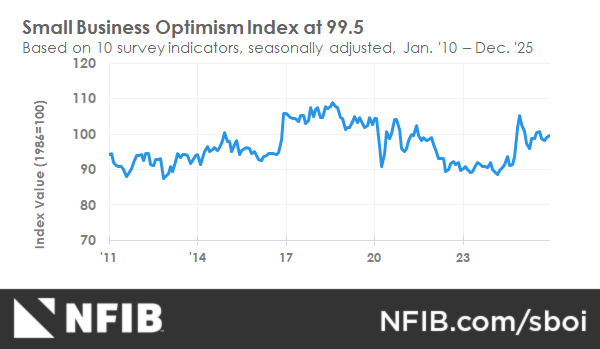

U.S. Small Business Optimism Hits Six-Month High

U.S. small business optimism rose in December as expectations for economic conditions improved and uncertainty declined, according to the latest NFIB survey.

Optimism among U.S. small business owners continued to improve in December, signaling growing confidence in economic conditions heading into 2026.

According to the latest survey from the National Federation of Independent Business (NFIB), the Small Business Optimism Index rose 0.5 points to 99.5, remaining above its 52-year average of 98.

Improving expectations drive optimism

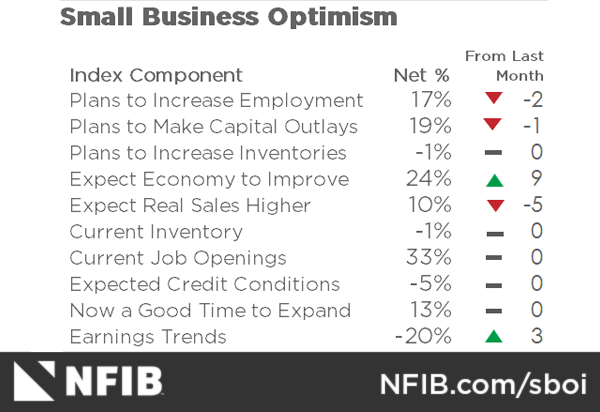

The increase was primarily driven by a sharp rise in the share of business owners expecting better economic conditions. The net percentage of respondents anticipating improvement jumped 9 points from November to 24%, marking the first increase since July.

At the same time, the NFIB Uncertainty Index fell 7 points to 84, its lowest level since June 2024, suggesting reduced anxiety around near-term economic outcomes.

Mixed signals on sales, pricing and investment

Despite improving sentiment, several operational indicators remained subdued. Actual sales continued to trail historical averages, while expectations for higher real sales volumes declined modestly.

Pricing pressures showed signs of easing. Both actual and planned price increases fell from November, although pricing activity remains elevated compared with long-term norms, indicating lingering inflationary pressure.

Capital spending picked up modestly in recent months, with over half of respondents reporting capital outlays in the past six months. However, plans for future investment remain historically weak, reflecting ongoing caution.

Labor and cost pressures persist

Labor market tightness remains a key challenge. One-third of small business owners reported unfilled job openings, well above the historical average.

Among those hiring, a large majority cited difficulty finding qualified applicants. Wage pressures continued, with a net 31% of firms raising compensation in December.

Borrowing conditions showed modest improvement, with fewer firms reporting higher interest rates on recent loans, marking the most favorable reading since early 2021.

Taxes emerge as top concern

Taxes ranked as the single most important problem for small businesses, cited by 20% of respondents — the highest level since May 2021.

Concerns related to labor quality, inflation and regulation remained significant, though several showed incremental improvement compared with earlier months.

What it means for the economy

The December survey suggests that while U.S. small businesses remain cautious, confidence is gradually improving as cost pressures ease and uncertainty declines.

With expectations for economic conditions turning more positive, small business sentiment may provide early support for broader economic stability in 2026, even as structural challenges around labor availability and taxation persist.

Source: NFIB Small Business Economic Trends Survey, December 2025.

Olivia Carter

Olivia Carter