US Data Center Investment Triples in Three Years as AI Drives Economic Growth

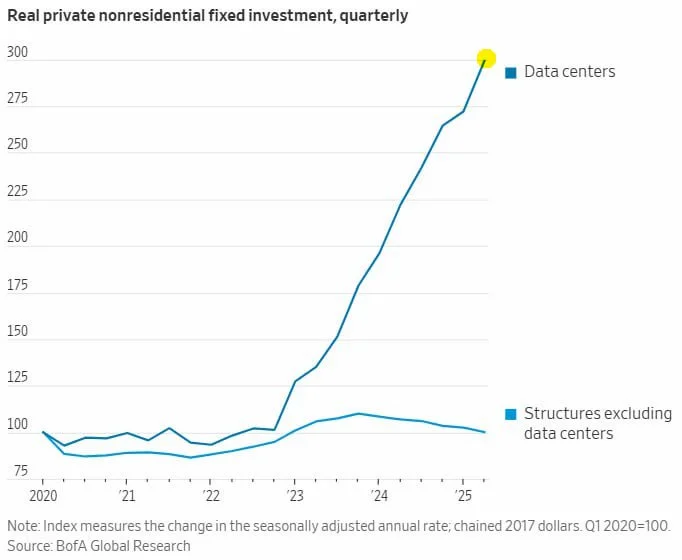

Record surge in U.S. investment into data centers — up ~300% in three years — shows how AI infrastructure is propelling macroeconomic growth, amid sluggish spending on traditional commercial real estate.

Investment in U.S. data centers has surged nearly threefold over the past three years, becoming a key driver of economic growth in 2025 — while spending on traditional structures remains nearly flat.

📈 Data-center investment vs. traditional structures: a sharp divergence

Recent data show that private nonresidential fixed real investment in U.S. data centers has skyrocketed over the past three years, reflecting a dramatic shift in how companies allocate capital. Over the same period, investment in other nonresidential structures — such as offices, shopping centers, hotels, warehouses and factories — has barely budged.

According to a report by Bank of America Institute, construction spending on data centers reached a record $40 billion annualized rate in June 2025, representing roughly a 30% year-over-year increase.

Meanwhile, global forecasts suggest that spending on data-center infrastructure could exceed $500 billion in 2025, driven largely by demand for AI infrastructure and hyperscale computing capacity.

Why the boom? AI demand & crypto mining among main drivers

The surge in data-center investment is tightly linked to the explosive growth of artificial intelligence and cloud computing. AI workloads — especially large-scale models and machine-learning tasks — require immense computing resources, pushing tech giants and cloud providers to rapidly expand their infrastructure footprint.

Some analysts also point to growing demand from crypto mining and other high-performance computing use cases as additional strain on data-center capacity. While precise numbers vary, the overall trend suggests a structural shift in investment priorities: from traditional real-estate structures toward digital infrastructure capable of powering the modern digital economy.

Macro implications — data centers driving GDP growth

According to research from S&P Global, data-center and AI-related investments accounted for up to 80% of U.S. private domestic demand growth in the first half of 2025.

Other sources estimate that without such investment, GDP growth would be close to zero — meaning the entire economy today partially relies on AI-driven infrastructure.

In short, data centers — once a niche backend infrastructure — are rapidly becoming one of the main pillars of the U.S. economy.

Risks and challenges ahead

However, this dependency on AI infrastructure is not without risks. Heavy capital spending on data centers typically requires large upfront investment. Some tech giants are already issuing substantial corporate debt to fund projects, which could weigh on financial stability if demand slows.

Furthermore, the energy consumption and environmental footprint of a rapidly expanding data-center fleet raise growing concerns. As demand for computing power rises, so does demand for electricity and cooling — potentially increasing environmental and regulatory pressure.

What this means for investors and markets

- Companies building or operating data centers — or producing hardware for them — may offer growth opportunities.

- Traditional real estate developers may feel pressure as capital shifts away from offices, retail space and industrial structures.

- Policymakers may accelerate measures on energy, infrastructure, and zoning to manage environmental and grid-capacity challenges.

Overall, the rapid expansion of AI and crypto-related infrastructure is reshaping the investment landscape — shifting focus from buildings and bricks to servers, cooling systems, and high-speed networks.

Amelia Hayes

Amelia Hayes