Infrastructure Is Massively Undervalued Compared to Global Equities, BlackRock Finds

BlackRock’s new 2026 Global Outlook reveals that global infrastructure assets are trading at unusually deep discounts, despite multi-decade demand from AI, energy and digital transformation.

From an editorial perspective, the disconnect between long-term demand and current pricing is one of the most striking findings in BlackRock’s new 2026 Outlook.

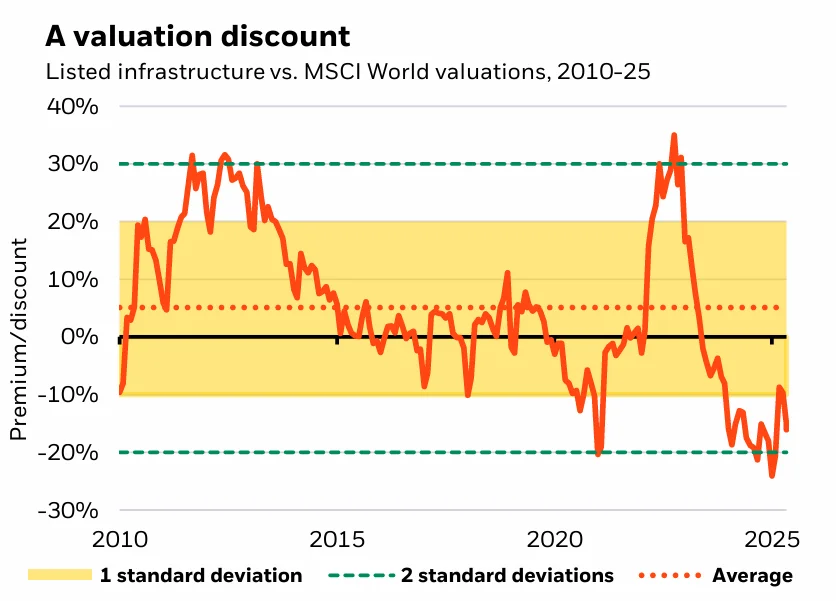

Infrastructure has become one of the most undervalued corners of global markets, according to BlackRock’s 2026 Global Outlook. Despite multi-decade tailwinds from AI expansion, energy transition and national security investment, listed infrastructure assets are trading at a deep discount relative to global equities — below levels seen during the global financial crisis and the Covid shock.

Valuations are far below historical averages

BlackRock’s analysis shows that the EV/EBITDA valuation gap between global infrastructure and the MSCI World index is near extreme lows. The firm describes this as an “attractive entry point” at a time when demand for essential assets — grids, power systems, transport, and digital networks — is accelerating.

The report notes that the discount reflects uncertainty around interest-rate paths rather than weakening fundamentals. In fact, the structural need for investment in power, connectivity and clean energy has never been higher.

AI makes infrastructure indispensable

As highlighted elsewhere in the Outlook, the AI buildout will require massive upgrades to electricity generation, transmission and data networks. Infrastructure, BlackRock argues, is central to enabling AI growth — regardless of which tech companies ultimately capture the economic upside.

“The infrastructure for AI is a permanent trend, and the race now is to secure the land, water and power to build it,” the report states, stressing that investors may be underestimating the magnitude of these needs.

Attractive across public and private markets

BlackRock sees opportunities in both listed and private infrastructure:

- Listed infrastructure offers historically low valuations and defensive cash flows.

- Private infrastructure provides access to emerging segments such as carbon capture, biofuels, storage and next-generation grid assets.

- Infrastructure debt — both investment grade and high yield — benefits from income potential and partial inflation linkage.

Multi-decade investment wave ahead

BlackRock expects structural demand for infrastructure to intensify over the next decade, driven by energy transition, increased defense spending, supply-chain reconfiguration and the rapid scaling of AI data centers. As these forces converge, the firm believes infrastructure could outperform major asset classes from a long-term perspective.

“Valuations do not reflect the opportunity,” the Outlook concludes, highlighting a widening gap between market pricing and the sector’s long-term fundamentals.

BlackRock’s full 2026 Global Outlook, including methodology and complete data tables, is available at the link below.

Olivia Carter

Olivia Carter