Global Billionaire Count Hits Record 2,919 as Wealth Soars to $15.8 Trillion—UBS

Global billionaire wealth surged to a record $15.8 trillion as the number of billionaires climbed to 2,919, driven by tech gains, asset appreciation, and the largest wealth-transfer wave on record, according to UBS.

From an editorial perspective, the significance lies in how rapidly global wealth concentration continues to accelerate, even amid geopolitical instability and uneven economic growth. According to the newly released UBS Billionaire Ambitions Report 2025, the number of billionaires worldwide reached 2,919, while their combined wealth climbed to an unprecedented $15.8 trillion—a 13% increase in just twelve months.

The report attributes this expansion to appreciating technology shares, broader financial-asset recovery, and an exceptional year for business innovation. As UBS notes, existing tech billionaires—particularly those exposed to the AI ecosystem—experienced some of the strongest wealth gains, while a new cohort of entrepreneurs and heirs joined the global billionaire population.

Global Increase Driven by the Americas and Tech Wealth

The Americas led all regions with billionaire wealth rising 15.5% to $7.5 trillion, reflecting the dominance of U.S. technology firms and resilient equity markets. Asia-Pacific followed with an 11.1% increase to $4.2 trillion, while Europe, the Middle East and Africa posted a 10.4% gain to $4.1 trillion.

Technology stood out as the fastest-expanding sector. Tech billionaires saw their collective wealth grow by 23.8%, adding over $583 billion—driven by soaring valuations in AI-related companies and renewed investor enthusiasm for next-generation digital infrastructure.

New Billionaires: Innovation Meets Inheritance

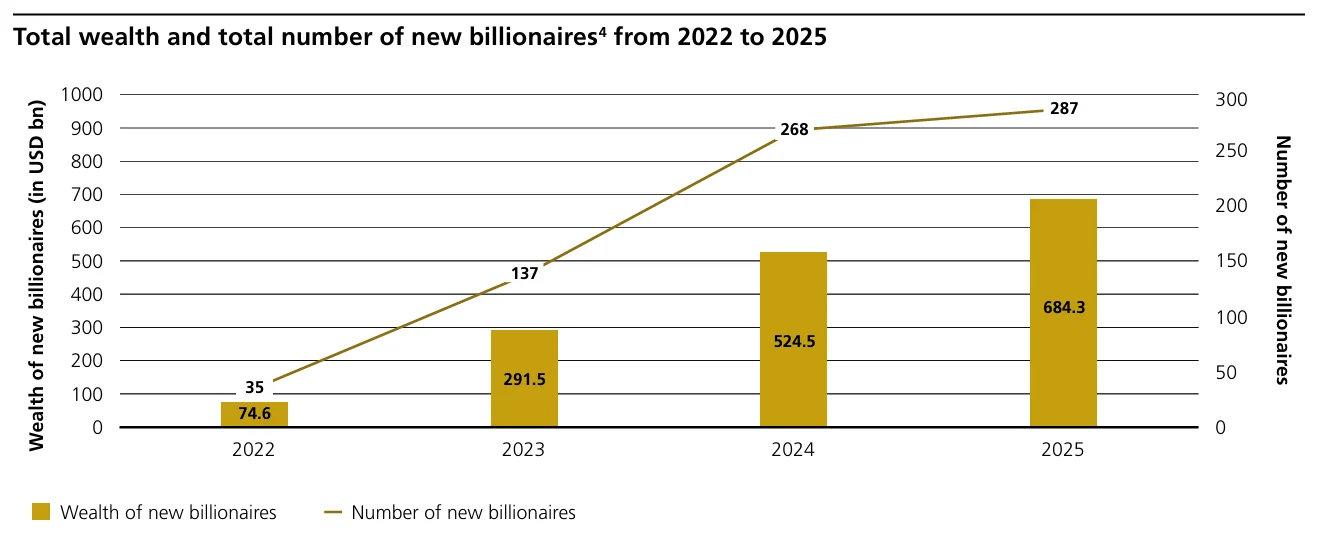

UBS identifies 196 self-made billionaires emerging in 2025 alone, marking the second-highest annual figure since 2021. Their new wealth—spanning marketing software, biotech, LNG, infrastructure, and consumer sectors—highlights a broad-based surge in entrepreneurial activity.

At the same time, inheritance reached its highest level on record. A total of 91 individuals became billionaires by inheriting $297.8 billion, up 36% year-over-year. Western Europe accounted for the largest share, with 48 heirs receiving $149.5 billion.

A Historic Wave of Wealth Transfer Is Accelerating

One of the report’s most consequential findings concerns the coming generational shift. UBS estimates that over the next 15 years, billionaire heirs will receive at least $5.9 trillion in transferred wealth—largely concentrated in the United States, Western Europe, India, and Greater China. The figure is conservative, as it excludes future asset appreciation.

This transition, UBS argues, will reshape global ownership structures and may exert significant influence on philanthropy, investment behaviour, and the evolving priorities of wealthy families.

Gender and Demographic Trends

The global billionaire population remains predominantly male—2,545 men versus 374 women. Yet female billionaires’ average wealth grew at more than twice the pace of men’s, supported primarily by consumer, retail, and materials sectors.

Meanwhile, billionaire mobility is rising: 36% report having relocated at least once, mainly due to quality-of-life considerations, geopolitical risks, or tax efficiency.

Key Risks Ahead

Despite record wealth creation, billionaires cite three dominant risks for the year ahead:

- Tariff escalation (66%)

- Major geopolitical conflict (63%)

- Policy uncertainty (59%)

These concerns underline the fragile macroeconomic backdrop against which wealth expansion has occurred—a dynamic that may shape investment decisions throughout 2025.

Ultimately, as historical cycles often show, periods of extraordinary wealth accumulation tend to coincide with deep structural shifts. UBS suggests that the rise of a new generation—both entrepreneurial and hereditary—will likely define global capital flows for decades to come.

Olivia Carter

Olivia Carter