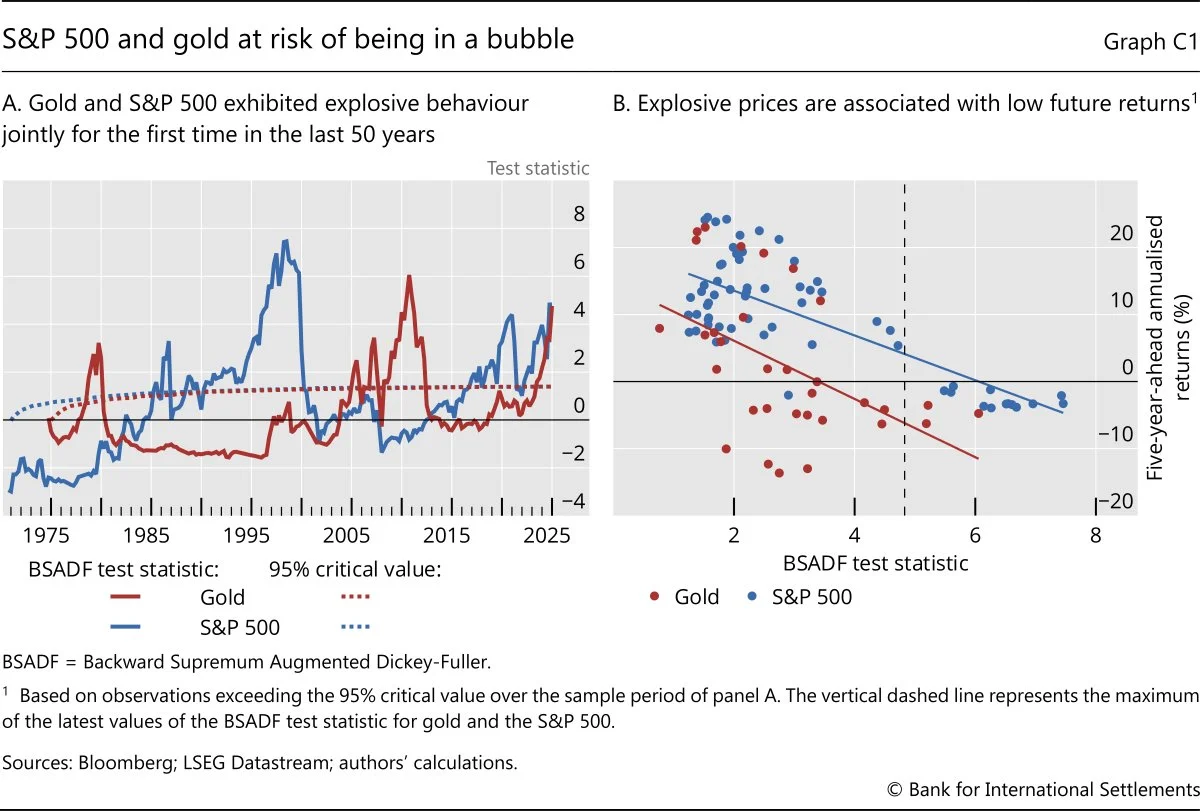

Gold’s Explosive Rally May End in Sharp Correction

BIS warns gold’s rally has shifted from safe-haven demand to speculation, calling the simultaneous surge with US stocks a rare 50-year anomaly.

The Bank for International Settlements (BIS) says gold may no longer be acting as a traditional safe-haven asset, pointing to a rare market anomaly: gold and US equities rising in tandem. According to BIS research cited by Bloomberg, this pattern has occurred only once in the past 50 years — and historically has signalled unstable market dynamics rather than defensive positioning.

Gold’s surge over the past year was initially driven by aggressive central bank buying and institutional flows hedging against fiat-system risks. But the composition of demand has since shifted. BIS notes that a growing wave of retail investors entered the market, amplifying momentum and pushing prices into what it describes as a potentially speculative phase.

A Rally Detached From Fundamentals

Traditionally, gold strengthens when risk assets weaken, acting as a stabiliser during periods of market stress. The current rally — unfolding alongside record highs in the S&P 500 — breaks that historical pattern. BIS argues that this “co-movement” indicates a behavioural shift where gold is traded less as a hedge and more as a risk-on asset.

The institution warned that such conditions often precede rapid and sharp corrections, particularly when speculative positioning becomes crowded. In previous cycles, transitions from defensive buying to retail-driven exuberance have been followed by fast, disorderly price reversals.

From Hedge to Bubble?

BIS researchers highlight that central banks and long-term allocators were the first movers in the latest gold uptrend. Their purchases reflected concerns ranging from geopolitical fragmentation to rising fiscal risks in major economies.

But once the rally gained momentum, retail demand grew disproportionately, adding what BIS describes as a layer of “frothiness” to the market. This shift raises the possibility that gold’s behaviour is now more consistent with bubble dynamics rather than haven flows.

If BIS is correct, the gold market may be approaching a pivotal moment. A speculative unwind could trigger outsized volatility, particularly if macro conditions tighten or sentiment turns abruptly.

Olivia Carter

Olivia Carter