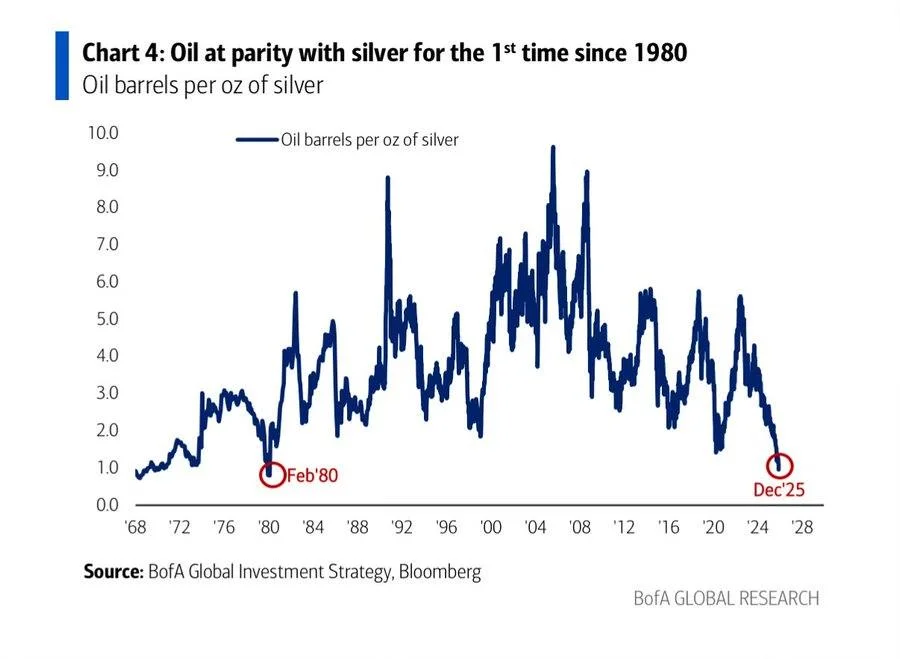

Oil Reaches Parity With Silver for First Time Since 1980

Oil has reached parity with silver for the first time since 1980. With silver supported by structural deficits and oil near multi-year lows, markets may be signaling a rebound in crude prices.

For the first time in more than four decades, one ounce of silver can buy roughly one barrel of oil. The oil–silver ratio has returned to levels last seen in early 1980, according to data from BofA Global Investment Strategy and Bloomberg.

From an editorial perspective, the significance lies not in the number itself, but in the conditions behind it. The last time this parity emerged, markets were shaped by extraordinary forces on both sides of the equation.

What happened in 1980

In February 1980, silver prices were driven to historic highs by the infamous Hunt brothers’ corner of the silver market. At the same time, oil prices were trading near cyclical peaks amid geopolitical tensions in the Middle East and the aftermath of the Iranian Revolution.

That equilibrium proved short-lived. Both assets eventually declined — but silver collapsed far faster once speculative pressure unwound.

Why today’s setup is different

Today’s parity reflects a very different macro backdrop. Oil prices are hovering near four-year lows, pressured by soft demand growth, rising non-OPEC supply and persistent concerns over global manufacturing activity.

Silver, by contrast, has been supported by a structural deficit in the precious metals market. Industrial demand tied to electrification, solar panels and advanced electronics has continued to rise, while mine supply growth has lagged (as historical cycles often show).

The result is a rare cross-commodity dislocation — one driven less by excess in silver and more by weakness in oil.

Which side adjusts next?

Historically, extreme commodity ratios tend to normalise through price adjustments in the weaker asset. Given current fundamentals, a sharp collapse in silver prices appears less probable than a recovery in crude.

In practical terms, this strengthens the case for a relative-value trade: selling silver exposure and rotating into oil at current levels. Such positioning aligns with past mean-reversion episodes following similar distortions.

Oil–silver parity is a rare signal. In 1980, it marked the end of a speculative excess in silver. In 2025, it may instead be pointing to undervaluation in oil.

Markets rarely repeat — but they do rhyme.

Olivia Carter

Olivia Carter