Why Silver Could Significantly Outperform the S&P 500 in the Years Ahead

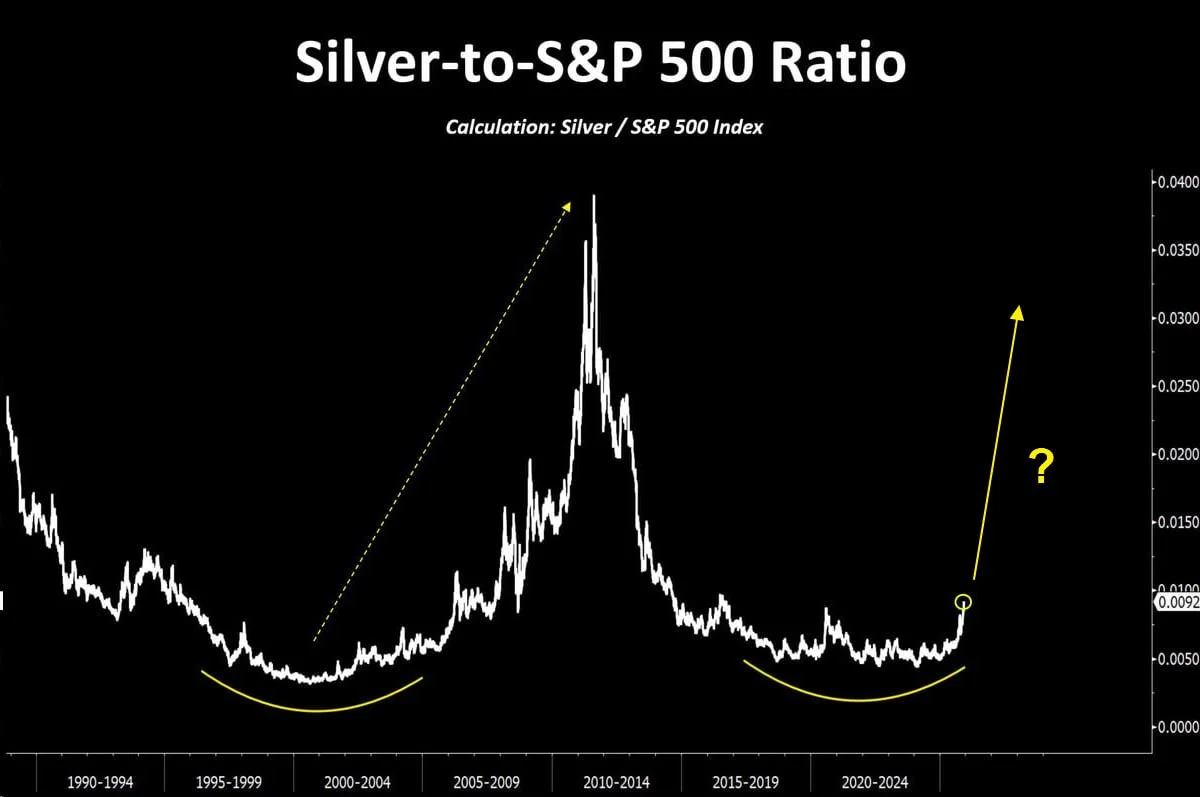

The silver-to-S&P 500 ratio remains near historic lows, a setup that Crescat sees as the early stage of a bullish macro cycle where silver could significantly outperform U.S. equities.

The silver-to-S&P 500 ratio remains near historical lows, highlighting just how far precious metals have lagged U.S. equities over the past decade.

The ratio, which measures silver prices relative to the S&P 500 index, is often used by macro investors to identify long-term regime shifts between hard assets and financial assets. Historically, extreme lows in this ratio have preceded periods of sustained silver outperformance.

What would drive a rebound in the ratio?

For the silver-to-S&P 500 ratio to rise meaningfully from current levels, one of two things must occur:

- U.S. equities decline relative to silver, or

- Silver prices rise faster than equity markets.

According to analysts at Crescat Capital, the latter scenario is increasingly likely. The firm argues that silver remains in the early stages of a bullish macro cycle, driven by a combination of monetary dynamics, supply constraints, and growing industrial demand.

“Silver is still in the early innings of a macro bull market and has the potential to significantly outperform U.S. equities over the coming years.”

Silver begins to outperform gold

An important confirmation of this thesis emerged earlier this year. Silver has started to outperform gold on a relative basis, a development that often occurs in the early and middle stages of precious metals bull markets.

Silver’s dual role — both as a monetary metal and a key industrial input — means it tends to lag during defensive phases, but accelerate sharply once broader macro conditions turn supportive.

Technical breakout strengthens the case

From a technical perspective, silver has already delivered an important signal. As Finmire previously reported, the metal recently completed a major long-term breakout, ending a multi-year consolidation phase.

That breakout suggested that silver’s advance may be structural rather than cyclical — a move supported by improving momentum, volume expansion, and relative strength versus both gold and equities.

Read more: A massive technical breakout suggests silver’s run might just be beginning

With the silver-to-S&P 500 ratio still hovering near historic lows, macro investors see an asymmetric setup. Even a partial mean reversion could imply substantial outperformance by silver over the coming years — particularly if equity valuations compress or monetary conditions ease.

For now, the ratio remains compressed. But history suggests that such extremes rarely persist indefinitely.

Olivia Carter

Olivia Carter