Are Commodities Setting Up for a New Supercycle in 2026?

The Bloomberg Commodity Index is forming a classic “cup and handle” pattern, a bullish technical setup that could point to a renewed commodities supercycle in 2026.

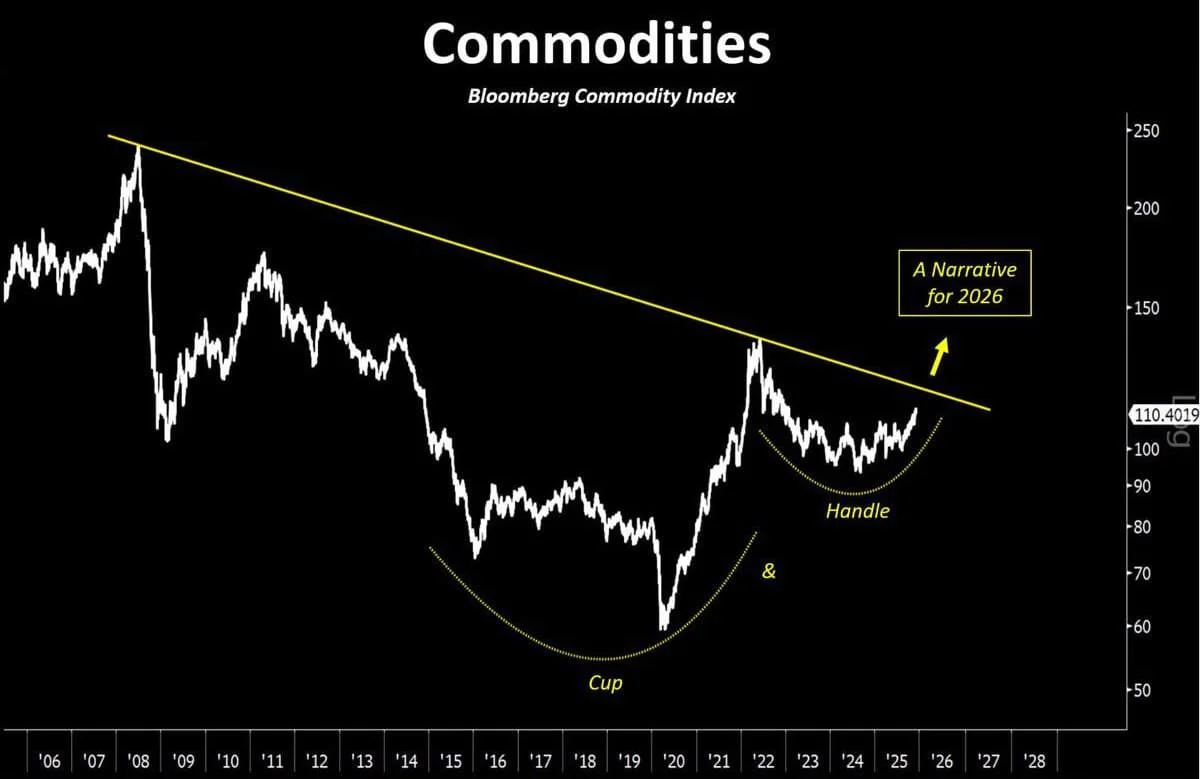

The Bloomberg Commodity Index is showing signs of a potentially powerful long-term bullish setup, according to technical analysis, raising the prospect that 2026 could mark the beginning of a renewed commodities supercycle.

On long-term charts, the index appears to be forming a classic “cup and handle” pattern — a well-known bullish formation that often precedes major upside breakouts when confirmed.

Breaking Down the Technical Structure

The pattern spans more than a decade and reflects a full commodity market cycle:

- The Cup (2011–2020): a prolonged correction, with the index falling from roughly 180 to 60 points.

- The Handle (2020–2025): a multi-year consolidation phase, largely contained within the 90–110 range.

- Potential Breakout: the index is now trading near 110, testing a long-term descending trendline.

If the pattern resolves to the upside, it would mark a structural shift after years of underperformance in commodity markets.

What a Breakout Could Mean

A confirmed breakout would suggest renewed upside momentum across raw materials, including energy, industrial metals, and agricultural products. Historically, such moves have coincided with inflationary pressures, capital rotation, and stronger performance from value-oriented sectors.

From a macro perspective, a sustained rise in commodity prices could also complicate the policy outlook for central banks, particularly if inflation expectations begin to reaccelerate.

How Investors May Position

Investors looking to gain exposure to a potential commodities upcycle typically consider several avenues:

- Broad-based commodity ETFs tracking diversified baskets of raw materials.

- Sector-specific exposure to energy, metals, or agriculture.

- Equities of commodity producers, which often provide leveraged exposure to rising prices.

- Gold as a hedge against inflation and macro uncertainty.

Implications for Equity Markets

A commodity-led rally could trigger a rotation away from high-growth equities toward value stocks and cyclical sectors. Rising input costs may pressure margins for consumer and technology companies, while firms with pricing power and balance sheet strength could outperform.

At the same time, higher commodity prices could reignite debates around monetary tightening if inflation shows signs of persistence.

Risks Remain

Despite the constructive technical setup, the pattern has not yet been confirmed. Technical formations do not guarantee outcomes, and false breakouts remain a risk. Investors should continue to manage exposure carefully and monitor macro and policy developments.

Still, if the breakout materialises, commodities could re-emerge as a central theme in global markets heading into 2026.

Lucas Grant

Lucas Grant