Milk Oversupply Drives Cheese Futures to Multi-Year Lows

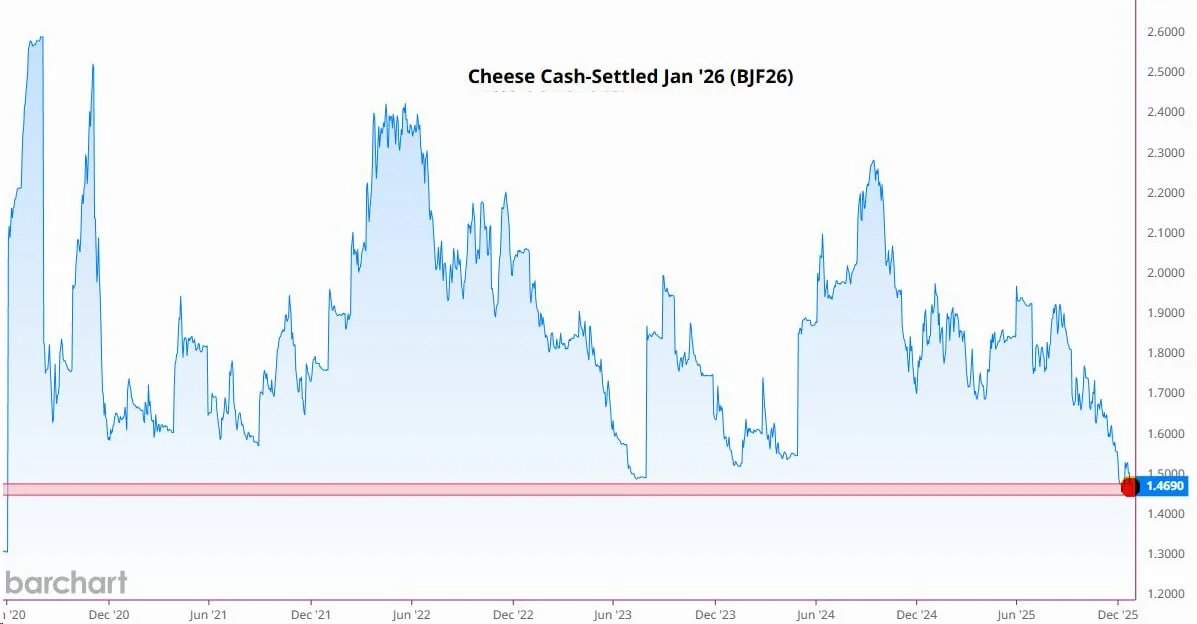

Cheese futures have fallen to their lowest level in six years as milk oversupply and soft consumer demand continue to pressure U.S. dairy markets.

Cheese futures have dropped to their lowest level in six years, reflecting persistent oversupply in the U.S. dairy market and weakening consumer demand.

Wholesale prices for key dairy products — including milk, butter, and cheese — have been under pressure for about a year, with a sharper decline occurring over the past six months, according to industry representatives.

Milk Oversupply Weighs on Dairy Prices

Industry analysts point to a surge in milk production as the primary driver behind falling dairy prices. U.S. milk output is up nearly 4% this year, significantly above the typical annual growth range of 1.5% to 2%.

That excess supply has translated into increased production of dairy products at a time when domestic demand has remained relatively soft, putting downward pressure on wholesale prices.

Butter and Cheese See Sharpest Declines

Price declines have been most pronounced in butter and cheese. Wholesale butter prices, which had traded above $3 per pound for nearly two years, have now fallen to roughly half that level.

Dairy markets have also experienced heightened volatility over the past 18 months, reflecting the cyclical nature of agricultural commodities and the biological constraints of milk production.

Retail Prices Lag Wholesale Moves

While wholesale prices have eased, retail prices tend to adjust more slowly. According to recent consumer price data, prices for milk, butter, and cheese have begun to decline, though the pass-through from wholesale markets typically occurs with a delay.

In November, the average price of a gallon of milk fell to approximately $4.00, down from $4.17 in August and lower than levels seen a year earlier.

Market participants note that retailers are often slower to reduce prices when commodity costs fall, meaning shoppers may see gradual rather than immediate relief at grocery stores.

Daniel Brooks

Daniel Brooks