Why Copper Prices Are Surging to Record Levels

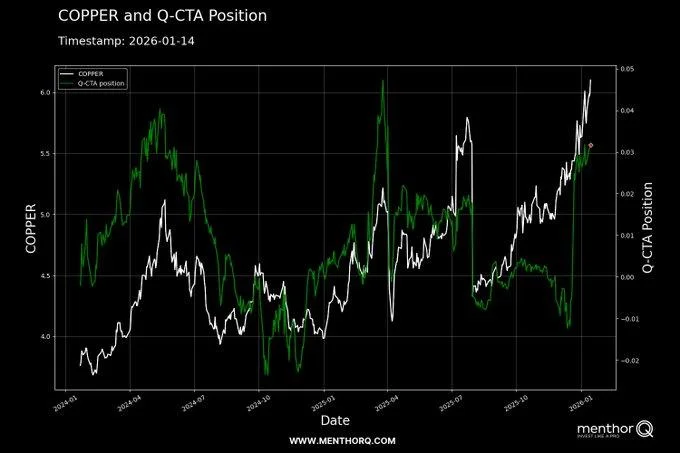

Copper prices have reached new all-time highs as easing rate expectations, AI-driven demand, and supply constraints reshape the global commodities landscape.

Copper prices have climbed to fresh all-time highs, reflecting a powerful combination of macroeconomic tailwinds and structural demand shifts that are redefining the metal’s role in the global economy.

Lower expectations for interest rates, improving sentiment toward China, persistent supply tightness, and uncertainty surrounding trade tariffs have all contributed to renewed investor interest in copper — particularly in the United States, where demand dynamics are becoming increasingly domestic and strategic.

AI infrastructure emerges as a key demand driver

Beyond traditional industrial uses, the rapid expansion of artificial intelligence infrastructure is becoming a decisive factor for copper demand. Each large-scale AI data centre begins not with software, but with physical infrastructure — and that infrastructure is copper-intensive.

Industry estimates suggest that a single modern AI data centre requires roughly $60 million worth of copper. The metal is embedded across internal wiring, server boards, power transmission lines, transformers, and distribution systems.

In a typical 100-megawatt data centre with a total project cost near $1 billion, copper alone can account for around 6% of total capital expenditures. This figure rises further as next-generation AI systems operate at higher temperatures, faster processing speeds, and heavier loads on power grids.

From mines to grids

U.S.-based data centres increasingly rely on domestically sourced copper, supplied by large mining operations that feed directly into national energy and digital infrastructure. The metal is not only critical for data centres themselves, but also for the expansion and reinforcement of power grids required to support them.

At the same time, supply growth remains constrained. New mining projects face long development timelines, regulatory hurdles, and rising costs, limiting the market’s ability to respond quickly to surging demand.

A structural shift, not a cycle

The current copper rally is increasingly viewed as structural rather than cyclical. While macro factors such as rate expectations and trade policy continue to influence short-term price action, the underlying demand from electrification, energy transition, and AI infrastructure points to a longer-term rebalancing of the market.

Daniel Brooks

Daniel Brooks