Lithium’s 2026 “Air Pocket” May Be the Pause Before the Next Structural Rally

Lithium demand is expected to dip in 2026 as China adjusts storage policies, but long-term growth driven by EVs and grid stability remains intact.

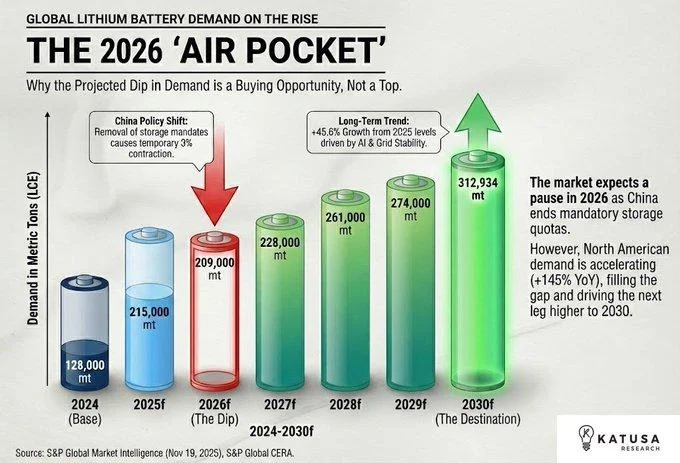

Lithium markets may be approaching a familiar phase in long-cycle commodities: a temporary pause inside a structurally bullish trend. According to industry projections, global lithium battery demand is expected to dip in 2026 before resuming a strong upward trajectory toward the end of the decade.

From an editorial perspective, the significance lies not in the dip itself, but in why it is happening — and what follows next (as historical cycles often show).

The 2026 “Air Pocket” Explained

The projected slowdown in 2026 is largely attributed to a policy-driven adjustment in China. As mandatory battery storage quotas are eased, near-term demand is expected to soften, creating what analysts describe as an “air pocket” — a temporary demand gap rather than a structural breakdown.

This phenomenon is not unusual in commodities tied to infrastructure and energy transitions. Demand pauses often emerge when policy timing, inventories, and capacity expansion briefly fall out of sync.

Long-Term Demand Drivers Remain Firm

Beyond 2026, forecasts point to a strong recovery. Global lithium demand is projected to grow by more than 45% from 2025 levels through 2030, driven by electric vehicles, grid-scale storage, and AI-related power infrastructure.

Notably, while China continues to lead price formation, momentum in North America is accelerating. Battery demand in the United States has risen by approximately 145% year-on-year, reflecting rapid EV adoption and investments in domestic supply chains.

Prices vs. Fundamentals

China remains the marginal price setter in lithium markets, meaning short-term price weakness may persist as the 2026 adjustment unfolds. However, prices alone do not tell the full story.

Supply growth remains capital-intensive and slow to scale, while downstream demand visibility continues to improve. Once excess inventories are absorbed, the market may quickly refocus on structural tightness heading toward 2030.

What Investors Are Watching

For long-term investors, the 2026 air pocket is increasingly viewed as a test of patience rather than a signal to exit. The key question is timing, not direction.

If historical commodity cycles are any guide, pauses driven by policy normalization often precede the next leg higher — especially when underpinned by multi-year electrification and energy transition trends.

Olivia Carter

Olivia Carter