Silver Breaks $100 for the First Time in History

Silver prices have surged past $100 per ounce for the first time, driven by expectations of rate cuts, strong industrial demand, and growing retail interest.

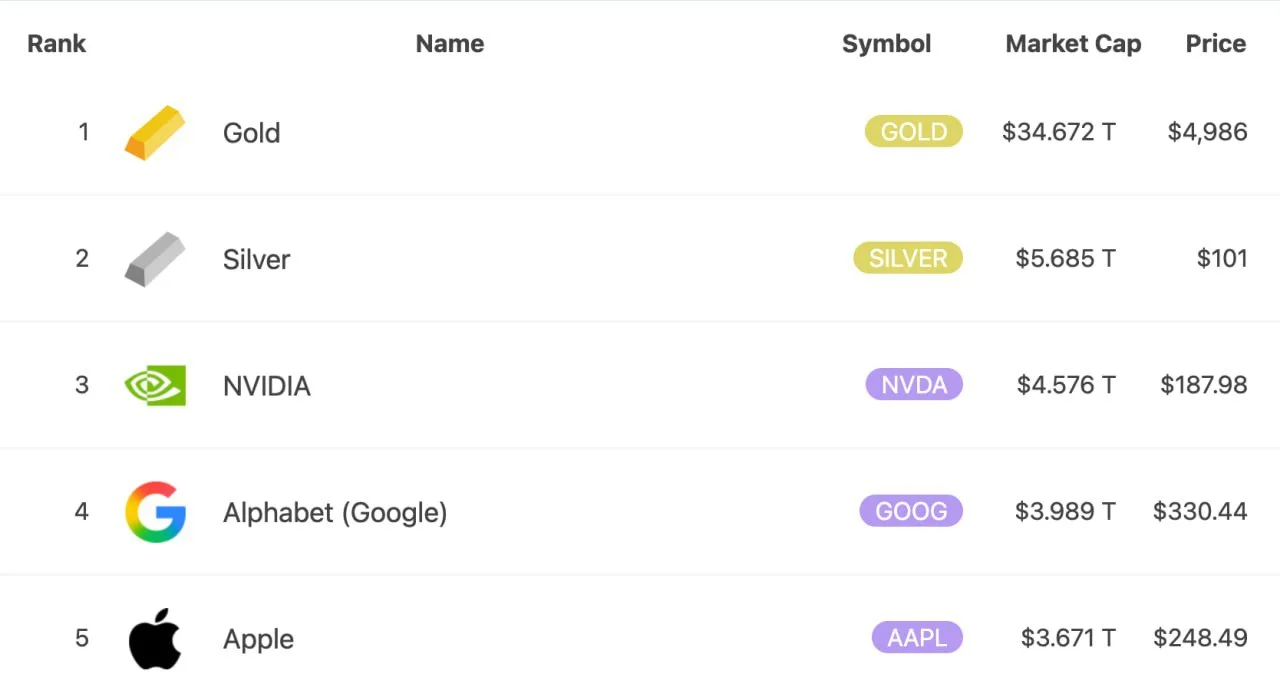

Silver prices have officially crossed the $100-per-ounce mark for the first time in history, extending a powerful rally that has accelerated sharply at the start of 2026.

Futures on silver traded on the Comex exchange climbed nearly 4% during the session, briefly moving above $100 and later extending gains to around $101 per ounce.

The move caps an extraordinary run for the precious metal. Silver gained approximately 141% over the course of 2025 and is already up about 40% since the beginning of this year.

What’s Driving the Rally

Several structural and macroeconomic factors are aligning in silver’s favour.

- Rate-cut expectations: Investors increasingly expect major central banks to begin easing monetary policy in 2026, boosting demand for non-yielding assets.

- Industrial demand: Consumption from electronics manufacturing and the solar energy sector continues to grow, tightening physical supply.

- Retail participation: Silver has seen rising interest from retail investors, including demand for physical bullion.

The combination of monetary expectations and real-economy demand has created a powerful feedback loop, pushing prices into uncharted territory.

Silver’s Growing Role in Portfolios

With gold already trading near record highs, silver is increasingly viewed as a complementary precious metal rather than a secondary one.

Its dual role — both as a monetary asset and an industrial input — has helped position silver as one of the strongest-performing commodities in the current cycle.

As silver clears the $100 threshold, investors are now debating whether this breakout marks a new long-term regime or the peak of an exceptionally strong momentum phase.

Olivia Carter

Olivia Carter