14 of the 25 Largest U.S. Banks Are Building Bitcoin Products for Clients

More than half of the 25 largest U.S. banks are developing Bitcoin-related products, signaling accelerating institutional adoption, according to River.

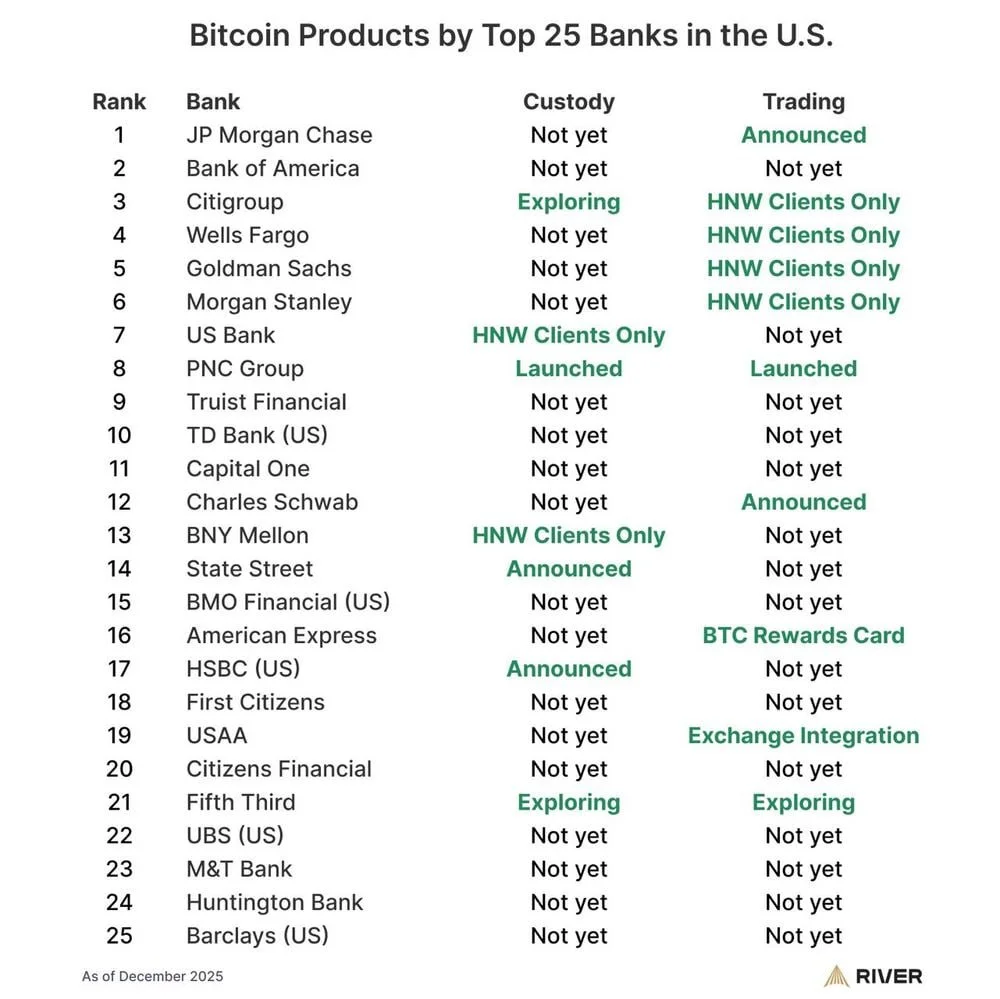

Fourteen of the 25 largest banks in the United States are currently developing, announcing, or already offering Bitcoin-related products for their clients, according to new data compiled by crypto financial services firm River.

The findings highlight a steady shift in how traditional financial institutions are approaching digital assets, with Bitcoin increasingly viewed as a long-te4erm component of wealth management rather than a fringe investment.

Bitcoin adoption varies by service type

River’s data shows that banks are moving into Bitcoin at different speeds and through different channels:

- Custody services remain the primary focus, particularly for high-net-worth (HNW) and institutional clients.

- Trading access is often limited to wealth management divisions rather than mass-market platforms.

- Several banks have announced initiatives but have yet to fully launch products.

Only a small number of institutions currently offer both Bitcoin custody and trading, while others are still in the exploratory or pilot phase.

Wall Street takes a cautious but clear approach

Major players such as Citigroup, Goldman Sachs, Morgan Stanley, and Wells Fargo are limiting Bitcoin exposure primarily to affluent clients, reflecting a cautious rollout strategy shaped by regulatory uncertainty and risk management considerations.

At the same time, banks like PNC Group have already launched both custody and trading services, positioning themselves ahead of peers in operational readiness.

From an editorial perspective, the significance lies not in how fast banks are moving — but in the fact that they are moving at all. After years of skepticism, Bitcoin is increasingly treated as financial infrastructure rather than speculation.

Regulation remains the key constraint

Despite growing interest, most large banks remain constrained by U.S. regulatory frameworks, particularly around custody rules, capital requirements, and compliance obligations.

This has resulted in a fragmented landscape where announcements outpace full-scale deployment. Still, industry observers note that internal development efforts often precede broader regulatory clarity.

Institutional Bitcoin is becoming unavoidable

With over half of America’s largest banks now engaged in Bitcoin-related initiatives, institutional adoption appears less a question of “if” and more a question of “how fast.”

As Bitcoin ETFs, custody infrastructure, and compliance tooling mature, banks are positioning themselves to meet client demand — even if rollout remains gradual.

Ethan Moore

Ethan Moore