The End of Bitcoin’s 4-Year Cycle? What the Data Now Shows

Historical data suggests Bitcoin’s classic four-year cycle is losing relevance as institutional adoption grows and volatility declines.

Bitcoin’s long-standing four-year market cycle may no longer be a reliable framework, according to analysts reviewing recent performance data.

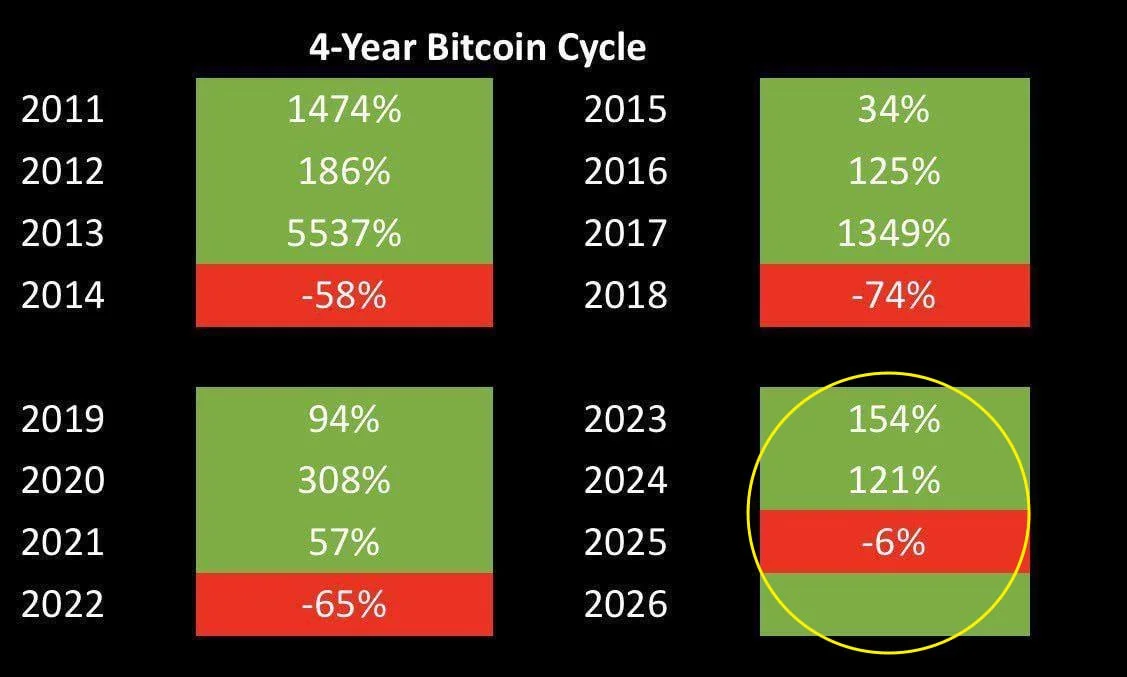

Historically, Bitcoin followed a relatively consistent pattern: three years of strong price appreciation followed by one year of deep correction. This “3 up, 1 down” structure closely aligned with halving cycles and defined bull and bear markets for more than a decade.

What the historical data shows

Looking at annual returns across previous cycles, the pattern was clear. Strong multi-year rallies in 2011–2013, 2015–2017 and 2019–2021 were each followed by sharp drawdowns exceeding 60% in the subsequent year.

The most recent cycle, however, looks different. While Bitcoin posted strong gains in 2023 and 2024, performance in 2025 has so far been only mildly negative rather than a full-scale capitulation. This deviation has reignited debate over whether the traditional cycle model still applies.

A maturing asset class

Market strategists argue that Bitcoin’s evolution into a more mature asset is reshaping its price dynamics. Growing institutional participation, deeper liquidity, and the expansion of regulated investment products are structurally reducing volatility.

As Bitcoin becomes increasingly integrated into traditional portfolios, its behaviour is beginning to resemble that of macro-sensitive risk assets rather than a purely speculative instrument. Large institutional flows and long-term allocation strategies are smoothing the extreme boom-and-bust patterns seen in earlier years.

What this means for investors

If the four-year cycle is indeed fading, strategies based solely on historical halving patterns may lose effectiveness. Instead, Bitcoin’s performance may depend more heavily on global liquidity conditions, monetary policy expectations and overall risk appetite.

This shift does not eliminate drawdowns altogether, but it suggests that future cycles may be shallower, longer and less predictable — signalling Bitcoin’s transition from an early speculative phase toward a more established market structure.

Ethan Moore

Ethan Moore