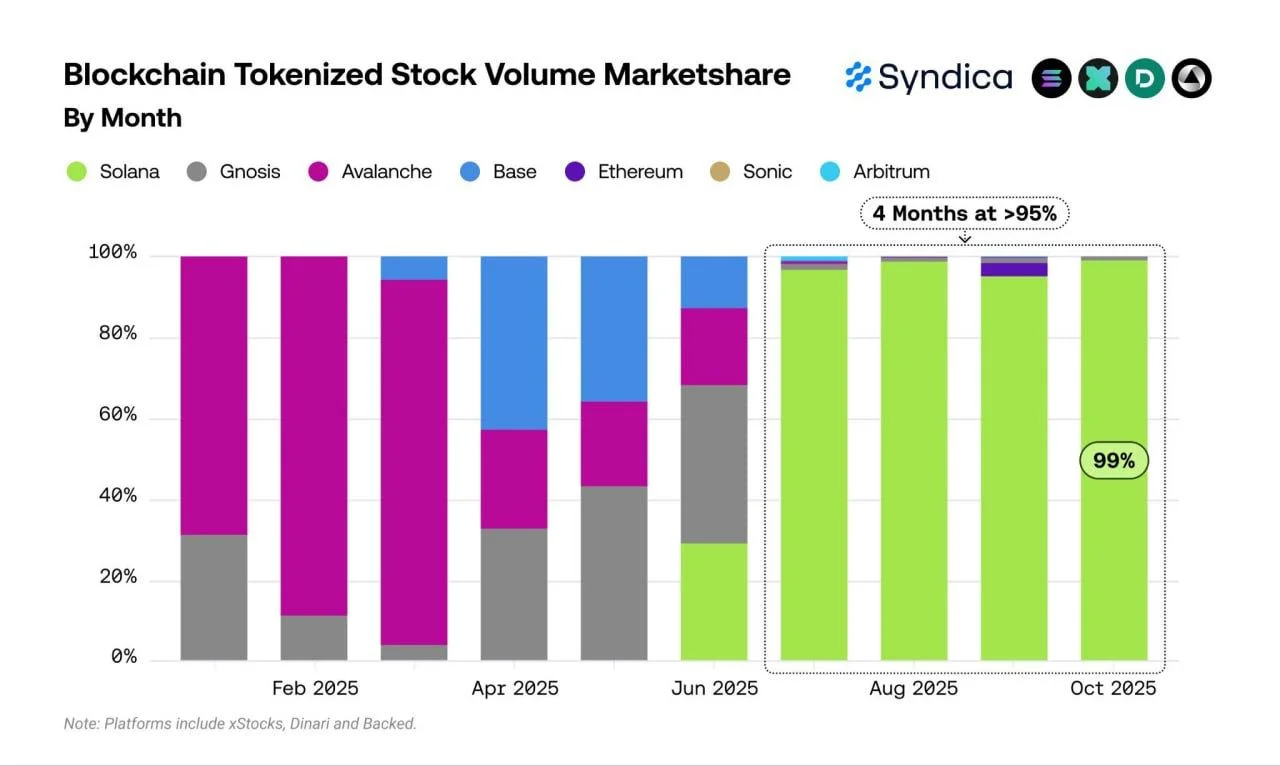

Solana Hits 99% Marketshare in Tokenized Stock Trading, Data Shows

Solana has held more than 95% of tokenized stock trading volume for four consecutive months, reaching 99% in October, according to Syndica.

Solana’s dominance in the tokenized equities market continues to accelerate, with new data from Syndica showing the blockchain has maintained more than 95% of total trading volume for four consecutive months. In October, Solana’s share briefly reached an extraordinary 99%, underscoring its rapidly growing relevance in the tokenized asset ecosystem.

The report highlights a dramatic shift in market structure throughout 2025. Earlier in the year, trading volume was more evenly distributed among networks such as Avalanche, Gnosis, Base, and Ethereum. But beginning in late summer, Solana’s throughput, low fees, and expanding infrastructure pushed it far ahead of competitors.

The surge is closely tied to increased activity on platforms such as xStocks, Dinari, and Backed, which have seen rising demand for tokenized versions of traditional equities. Solana’s ability to handle high-volume, low-latency transactions has positioned it as the most efficient environment for these markets.

In contrast, rival blockchains have seen their share fall sharply, with most dropping into single-digit territory by October. Syndica’s chart indicates Solana’s lead stabilized above 95% from July through October, marking one of the most concentrated periods of market dominance in the tokenized asset sector.

While the broader tokenization industry remains in its early stages, Solana’s sustained leadership suggests that infrastructure performance continues to be a decisive factor in market adoption.

Ethan Moore

Ethan Moore