Institutional Bitcoin Demand Hits Record Levels in 2025

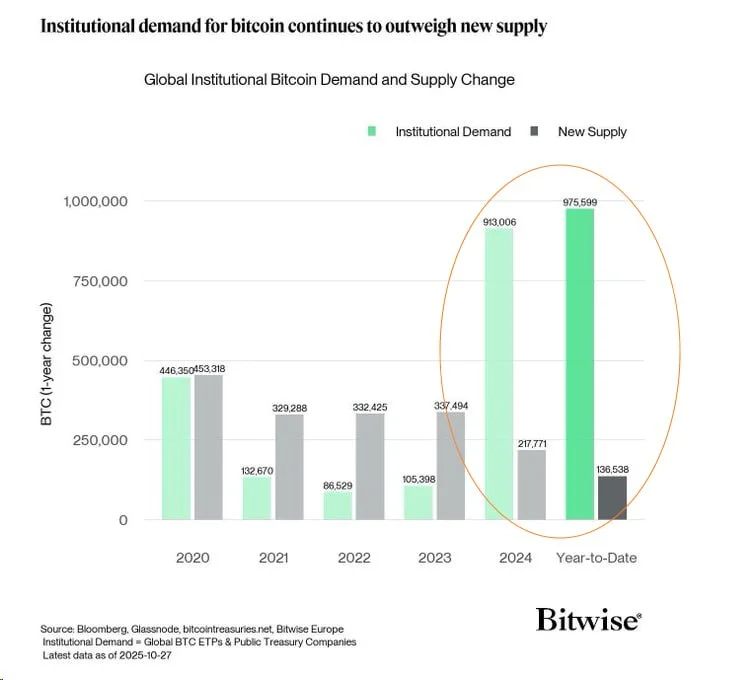

New Bitwise data shows institutional demand for Bitcoin far exceeds new supply in 2025, creating the strongest supply-demand imbalance to date.

Institutional demand for Bitcoin has surged to unprecedented levels in 2025, according to new data from Bitwise. The latest figures show that large investors are absorbing BTC at a pace far exceeding new supply entering the market.

The report highlights a widening structural imbalance: while annualized new supply stands at just 136,538 BTC year-to-date, institutional demand has reached an estimated 975,599 BTC. This means institutions are demanding more than seven times the amount of Bitcoin being created.

Bitwise data also shows a dramatic jump from 2024, when institutions acquired 913,006 BTC against 217,771 BTC in new supply. The demand spike has accelerated further throughout 2025, driven by ETFs, corporate treasuries, and global asset managers increasing exposure.

Why the gap keeps widening

Several long-term factors appear to be contributing to the imbalance:

- Strong inflows into Bitcoin ETPs across the U.S. and Europe.

- Growing corporate adoption of BTC as a treasury reserve asset.

- Reduced new issuance following the most recent Bitcoin halving.

Because Bitcoin’s supply schedule is fixed, analysts note that rising institutional participation naturally tightens available supply — and 2025 is shaping up to be the most significant example of that dynamic to date.

Market implications

Although the data does not predict price direction, the scale of the supply-demand mismatch suggests that institutions continue to play an increasingly dominant role in Bitcoin’s ecosystem. If the trend persists, liquidity conditions could tighten further, especially as more structured investment vehicles emerge.

For now, the numbers from Bitwise provide one of the clearest indications yet that Bitcoin’s supply landscape in 2025 is being reshaped by sustained institutional accumulation.

Ethan Moore

Ethan Moore