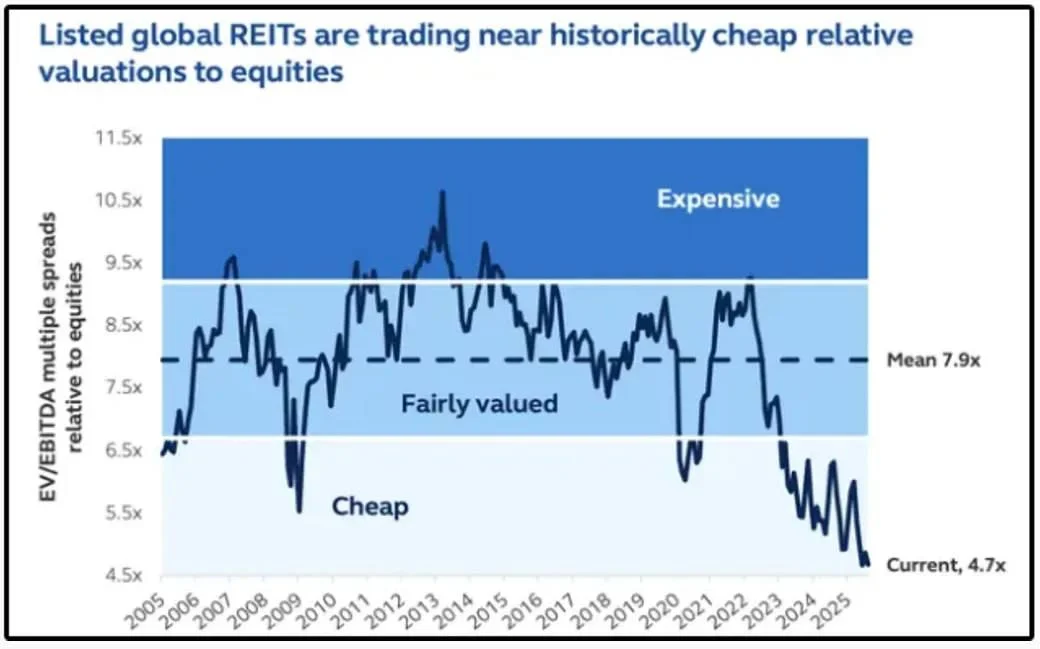

Why REIT Valuations Have Fallen to Rare Discounts

Global REITs are trading near historically low valuations relative to equities as high interest rates and sector-specific risks weigh on sentiment.

Listed global real estate investment trusts (REITs) are trading near historically low relative valuations compared with equities, reflecting the combined impact of higher interest rates, shifting investor preferences and lingering concerns over commercial property markets.

What are REITs?

REITs are publicly traded vehicles that own and operate income-generating real estate assets such as offices, logistics centres, shopping malls and data centres. By regulation, they distribute the majority of their earnings to investors, effectively offering exposure to real estate through a stock market structure.

Why REITs have underperformed

The sector’s prolonged weakness has not been driven by a single factor, but by a convergence of macro and structural pressures.

- High interest rates have increased borrowing costs, compressing cash flows and limiting refinancing flexibility.

- Attractive bond yields have drawn income-focused investors away from REITs toward fixed-income assets.

- Structural concerns around offices and certain segments of commercial real estate have intensified risk aversion.

As a result, REITs have de-rated sharply and now trade at valuation multiples relative to equities that the market has rarely observed outside major stress periods.

Valuation gap widens

On an EV/EBITDA basis, global REITs are currently priced well below their long-term average relative to equities. Historically, such valuation gaps have tended to emerge during periods of aggressive monetary tightening, when capital costs rise faster than rental income can adjust.

What could change the outlook

The medium-term trajectory for the sector will largely depend on the direction of monetary policy. A shift toward lower interest rates could materially improve the operating environment for REITs.

- Debt servicing costs would decline.

- Dividend yields could regain competitiveness versus bonds.

- Investor focus may return to assets backed by tangible property and recurring cash flows.

A longer-term perspective

At current levels, REITs are less about short-term performance and more about asymmetric positioning. While risks remain, downside appears increasingly defined by already compressed valuations, whereas potential upside would benefit from even modest improvements in rates, sentiment or capital allocation.

Markets tend to discount such assets aggressively during periods of uncertainty. Historically, those moments often appear obvious only in hindsight.

Daniel Brooks

Daniel Brooks