De-Dollarization Meets Crypto — Coinbase Explains the Stablecoin Paradox

Coinbase Institutional says stablecoins sit at the center of a growing tension between de-dollarization and crypto adoption, reshaping global payments in unexpected ways.

Crypto’s most disruptive impact may be monetary, not technological. In its Crypto Market Outlook 2026, Coinbase Institutional explores how the rapid rise of stablecoins is colliding with a broader global trend toward de-dollarization — creating outcomes that are far less straightforward than many expect.

The return of the dollar question

De-dollarization gained renewed momentum in 2025 as geopolitical fragmentation, sanctions regimes, and shifting trade relationships pushed countries and institutions to reduce reliance on the U.S. dollar. At the same time, crypto adoption — particularly through stablecoins — accelerated globally.

At first glance, these trends appear aligned. Yet Coinbase argues that their interaction is more complex, and potentially paradoxical.

Stablecoins as a disruption layer

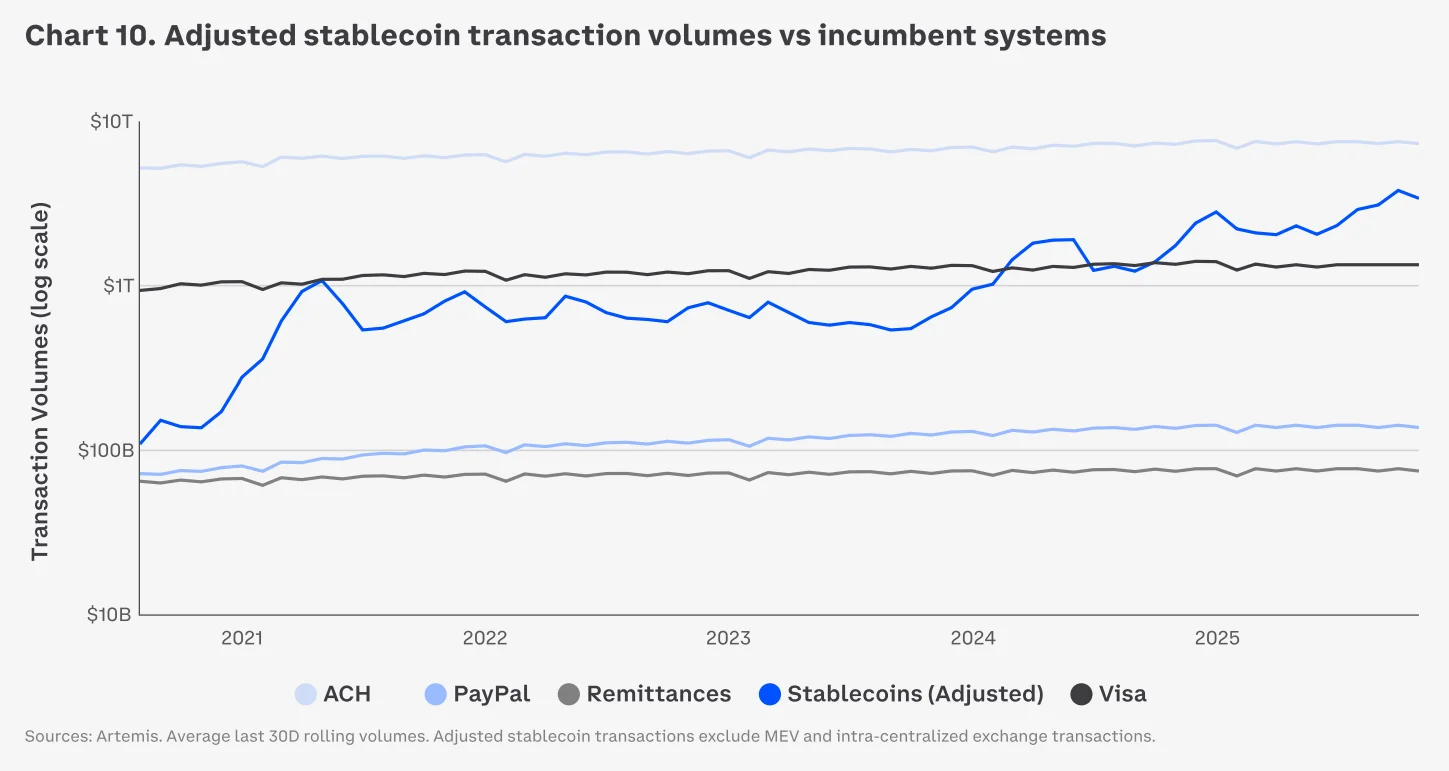

Stablecoins introduce a new form of monetary infrastructure: digital, programmable, borderless representations of fiat currency. This allows value to move globally with far greater speed and efficiency than traditional correspondent banking networks.

From an operational standpoint, this is disruptive. From a currency perspective, however, the implications are less clear-cut.

The dollar paradox

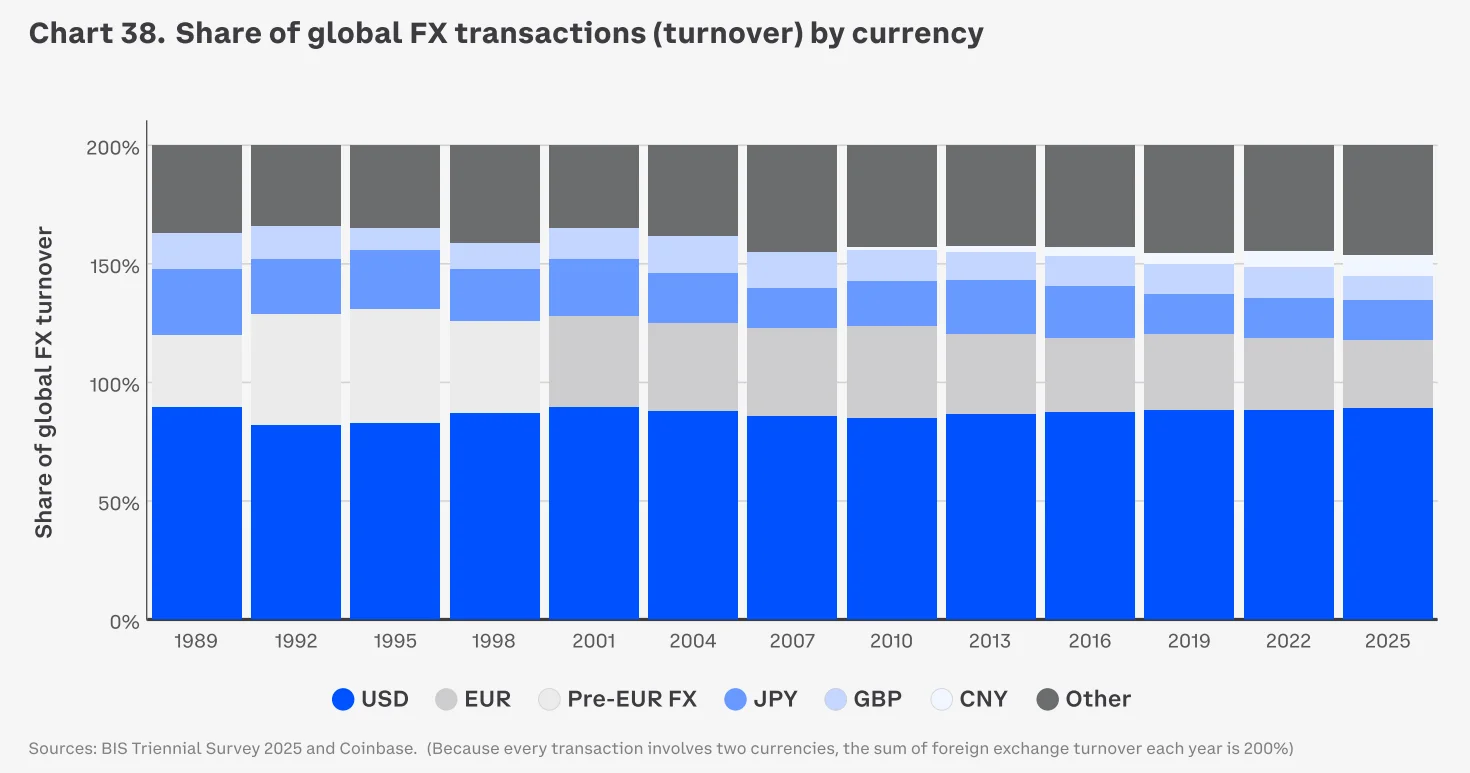

Coinbase highlights a key contradiction. While stablecoins offer an alternative to traditional banking rails, the vast majority remain pegged to the U.S. dollar. As a result, widespread stablecoin adoption could inadvertently extend the dollar’s reach rather than weaken it.

By making USD-denominated value easier to store, transfer, and settle across borders, blockchain infrastructure may reinforce the dollar’s role in global commerce — even as political efforts aim to diversify away from it.

Why this matters for global finance

This dynamic matters because it reshapes how monetary power is exercised. Instead of flowing through central banks and correspondent networks, dollar liquidity can now move via crypto-native rails, often outside traditional financial intermediaries.

Coinbase suggests this could lead to a reconfiguration of global financial plumbing — one where access and efficiency improve, but control and oversight evolve more slowly.

What disruption really looks like in 2026

- Faster settlement: Cross-border payments increasingly bypass legacy systems.

- Currency persistence: USD dominance may persist through new technological channels.

- Policy tension: Regulators face trade-offs between innovation, oversight, and monetary influence.

Key takeaways

| Theme | Coinbase’s view |

|---|---|

| De-dollarization | Structural trend, but not a linear decline of USD dominance. |

| Stablecoins | Disrupt payment rails while potentially reinforcing the dollar. |

| Global impact | Financial power shifts toward infrastructure, not just currency choice. |

Source: Coinbase Institutional, Crypto Market Outlook 2026.

Olivia Carter

Olivia Carter