Gen Z Spending Is Outpacing the Broader Population Across Key Categories

New transaction data shows Gen Z household spending is growing faster than the overall population across multiple consumer categories, highlighting a shifting demand profile.

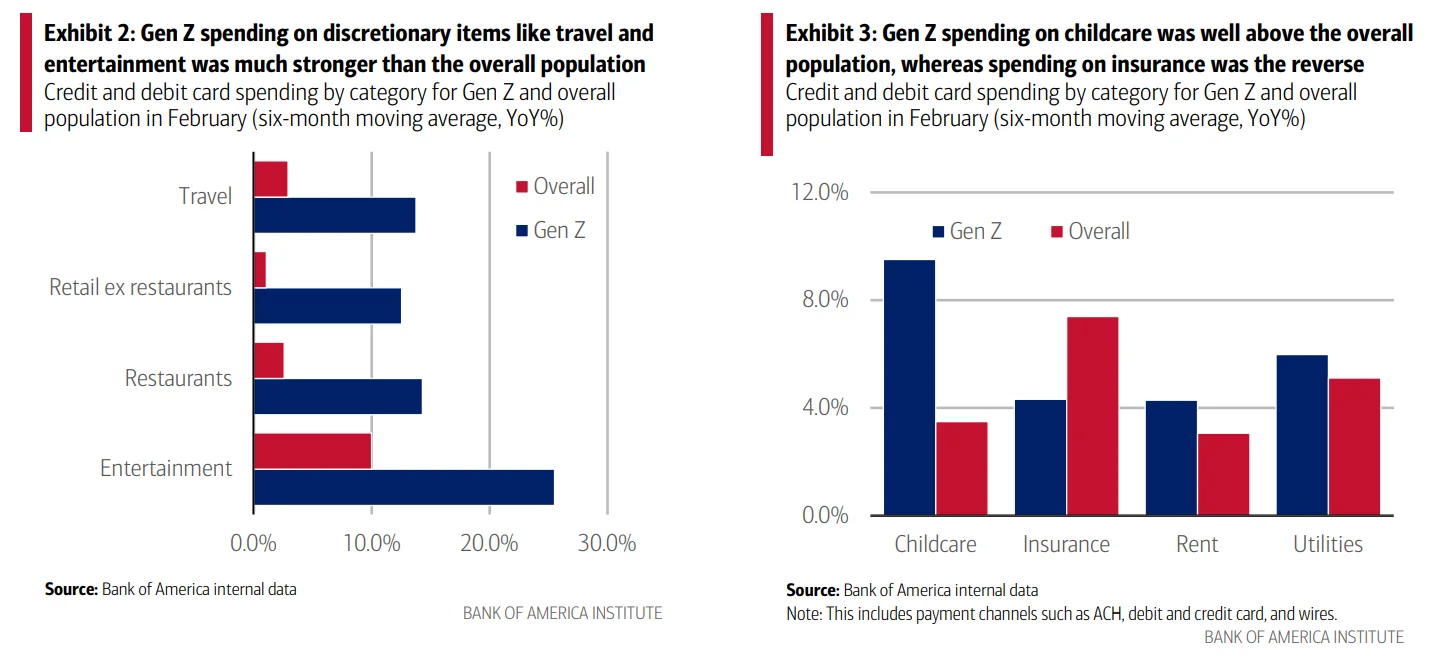

New transaction-based analysis from the Bank of America Institute shows that while Generation Z still represents a smaller share of total consumer spending, its household spending growth is exceeding that of the broader population across several key categories.

The analysis is based on aggregated and anonymised credit and debit card transaction data, offering a granular view of household spending behaviour across age cohorts.

This divergence is visible across both discretionary and essential areas of consumption, suggesting that Gen Z’s economic footprint is expanding faster than headline consumption figures alone might imply.

In discretionary categories, Gen Z households have recorded stronger year-over-year spending growth than the overall population. The gap is particularly visible in travel and entertainment, where spending momentum among younger consumers has been notably more resilient.

This pattern points to a consumer cohort that continues to prioritise mobility, experiences, and social activity, even as broader economic uncertainty persists.

At the same time, Gen Z spending growth has also exceeded the population average in several non-discretionary categories. Outlays related to rent, utilities, and childcare have risen at a faster pace, reflecting sustained cost pressures rather than changing preferences.

The combination of faster discretionary and essential spending growth underscores a central tension. Gen Z is becoming a more active driver of consumption, but much of that growth is occurring alongside elevated living costs that limit financial flexibility.

The implication is structural rather than cyclical. As Gen Z’s share of economic activity rises over time, shifts in their spending behaviour are likely to play an increasingly important role in shaping sector-level demand and broader consumption trends.

Olivia Carter

Olivia Carter