Gen Z Earns More — but Faces a More Fragile Financial Reality

Bank of America Institute data shows strong wage growth for Gen Z, alongside rising job insecurity and limited financial buffers.

Generation Z is earning more — but feeling less secure. New analysis from the Bank of America Institute reveals a growing disconnect between rising wages and financial stability among the youngest cohort in the labour market.

Based on aggregated and anonymised transaction and deposit data, the research highlights a structural imbalance: income momentum has improved, yet financial resilience has not kept pace.

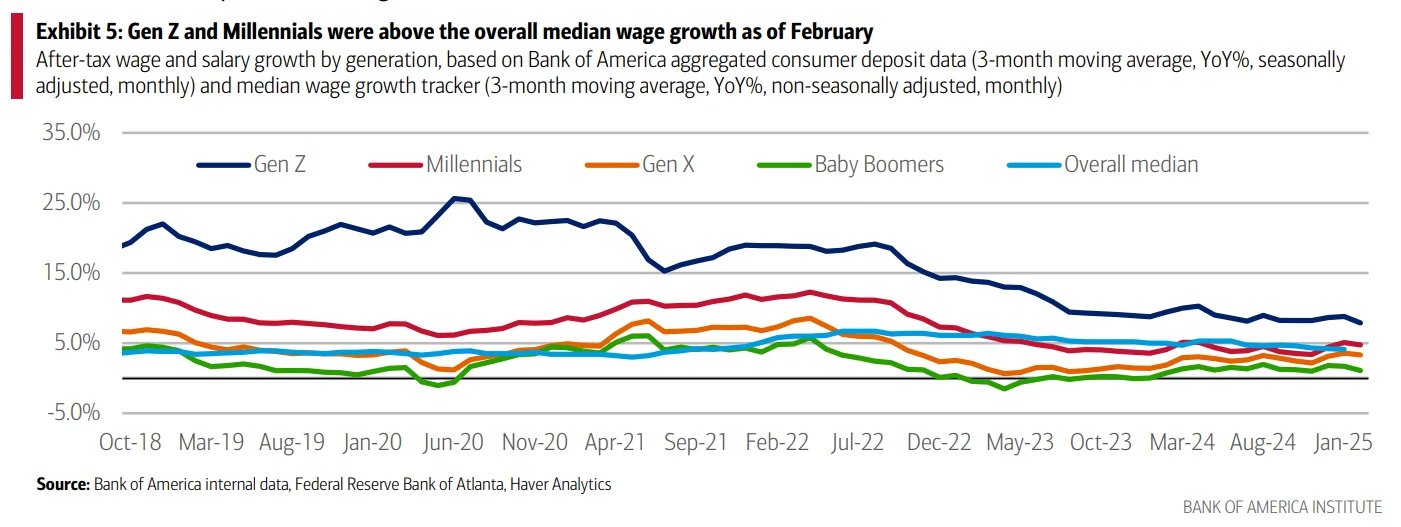

Among those who are employed, Gen Z has recorded the fastest wage growth of any generation in recent periods. Entry-level pay gains and post-pandemic labour tightness have supported stronger income growth relative to older cohorts.

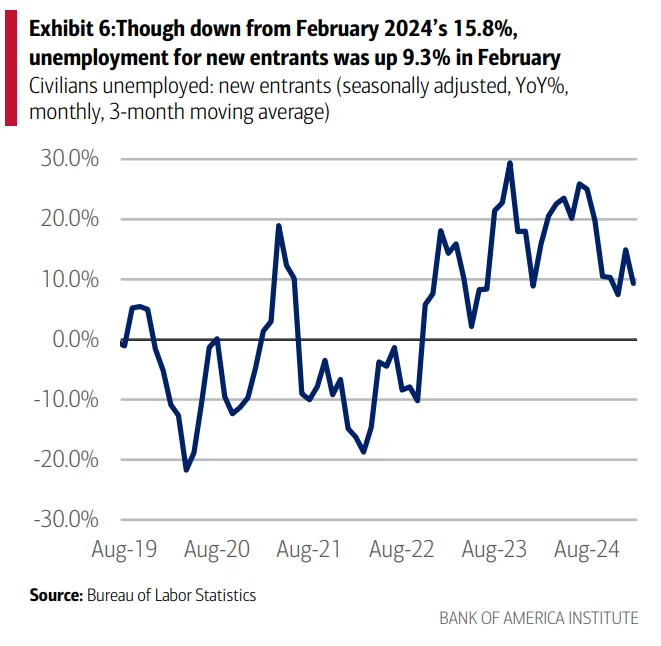

But the labour market picture is uneven. For new entrants, unemployment has been rising year over year, signalling that securing stable employment has become more challenging for younger workers.

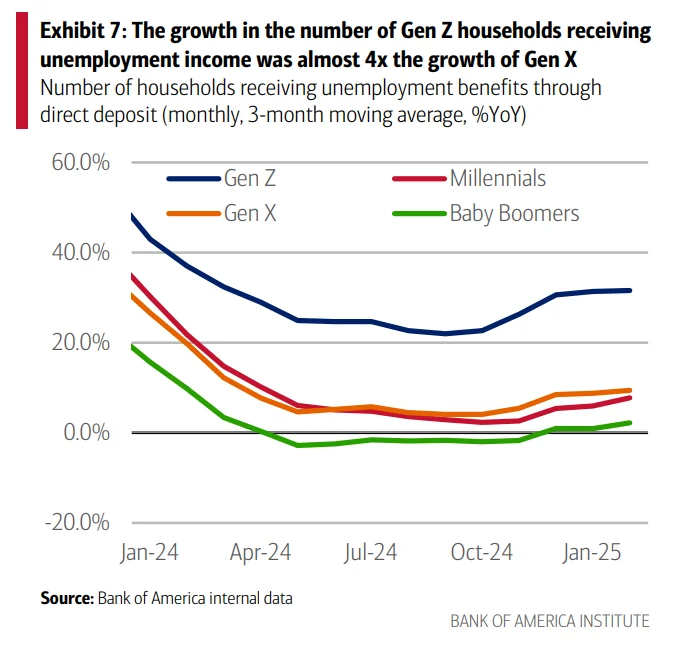

Conditions deteriorate further for those who lose work. The number of Gen Z households receiving unemployment benefits has increased sharply compared with the prior year, outpacing growth among older generations.

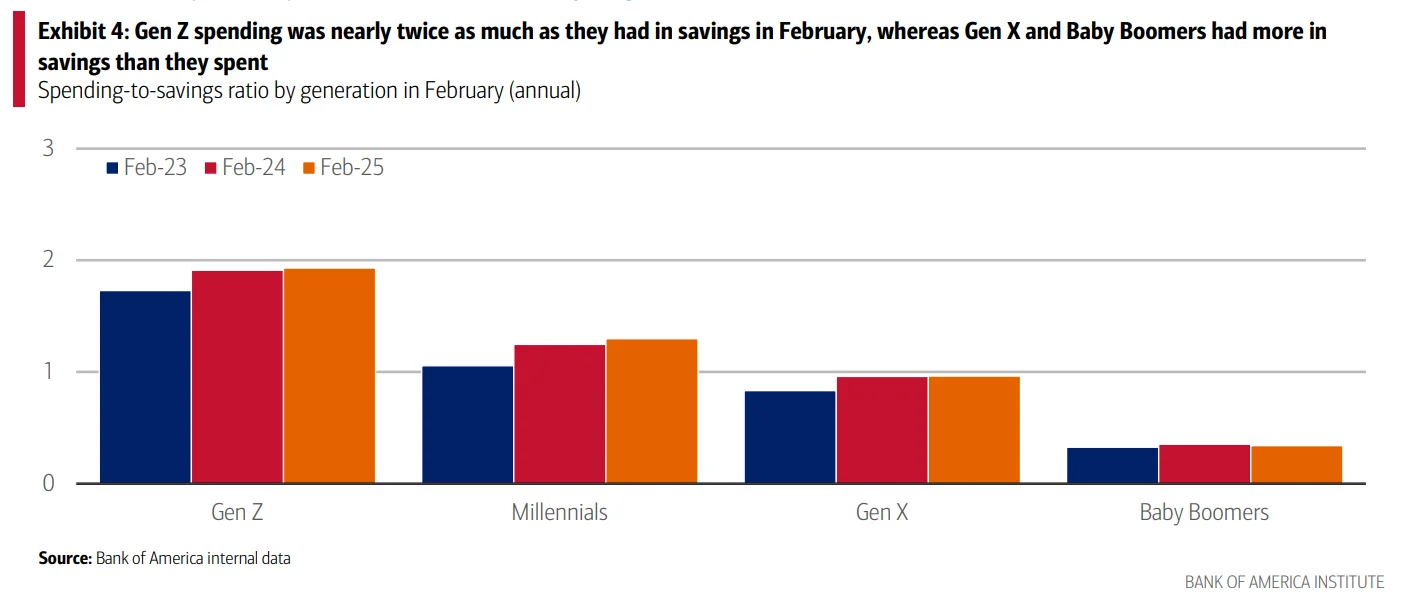

At the household level, financial buffers remain thin. On average, Gen Z continues to spend significantly more than it holds in savings, leaving little room to absorb income shocks or rising living costs.

The takeaway is a fragile equilibrium. Generation Z is entering the economy with rising earning power, but without the financial cushions that supported previous cohorts. As their economic footprint expands, this imbalance may amplify volatility in consumption and labour markets.

Olivia Carter

Olivia Carter