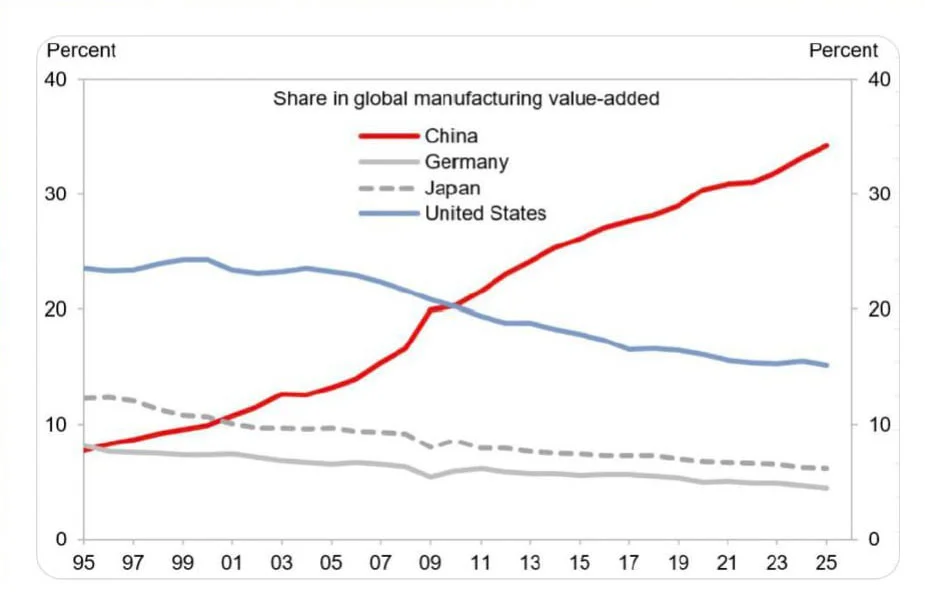

China Now Produces More Than the U.S., Japan and Germany Combined

China continues to expand its share of global manufacturing value added, now exceeding the combined output of the U.S., Japan and Germany, according to long-term data.

China continues to strengthen its dominance in global manufacturing, steadily increasing its share of worldwide value added while the positions of the United States, Japan and Germany continue to erode.

According to long-term data on global manufacturing value added, China’s share has risen almost uninterrupted since the late 1990s. Today, it stands at more than 30% of total global manufacturing output.

By contrast, the United States has seen its share decline from the mid-20% range in the late 1990s to roughly 15% today. Japan and Germany have experienced an even more pronounced structural decline, each now accounting for only single-digit percentages of global manufacturing.

In aggregate, China now produces more manufactured value than the United States, Japan and Germany combined. This marks a decisive shift in the global industrial balance — one that has been building for decades rather than emerging suddenly.

Structural forces behind China’s dominance

China’s rise reflects a combination of scale, supply-chain integration and long-term industrial policy. Over time, manufacturing ecosystems clustered around logistics hubs, export infrastructure and increasingly advanced domestic demand.

Meanwhile, developed economies have shifted toward services, technology and finance, gradually offshoring large portions of their industrial base. Labour costs, environmental regulation and shareholder-driven capital allocation have reinforced this trend.

Can the trend be reversed?

U.S. policymakers — including former president Donald Trump — have attempted to reverse the trajectory through tariffs, reshoring incentives and industrial subsidies. While these measures have slowed the pace of decline in some sectors, the data suggest that the structural gap remains intact.

Even during periods of trade tension and geopolitical fragmentation, China’s manufacturing share has continued to rise — suggesting deep-rooted competitive advantages rather than cyclical effects (as historical cycles often show).

Olivia Carter

Olivia Carter