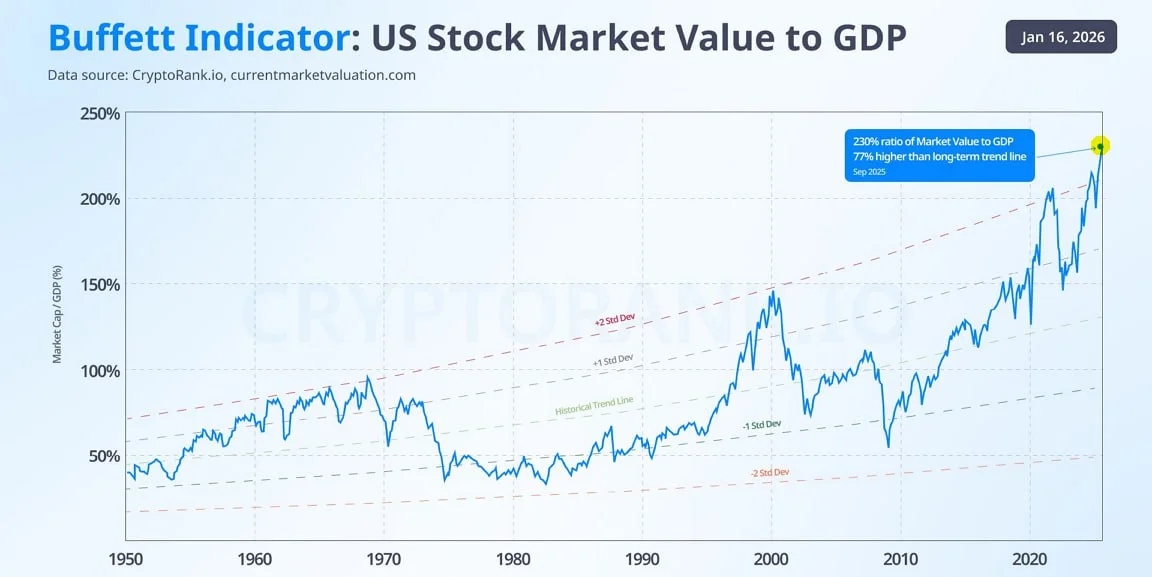

The Buffett Indicator Sends Its Loudest Signal Yet

U.S. stocks continue to climb as valuation metrics hit historic extremes. The Buffett Indicator reaches 230% while household equity exposure rises to record levels.

From an editorial perspective, the significance lies not in price action alone, but in the widening disconnect between markets and the real economy. The ongoing rally in U.S. equities is increasingly drawing concern among analysts as key valuation metrics push well beyond historical norms.

The gap between total U.S. stock market capitalisation and nominal GDP — commonly referred to as the Buffett Indicator — has now climbed to approximately 230%. This represents one of the most extreme readings on record, surpassing levels seen during previous market peaks.

Historically, such elevated readings have been associated with periods of heightened vulnerability rather than sustained stability. While valuation alone is a poor timing tool, the magnitude of the divergence is difficult to ignore.

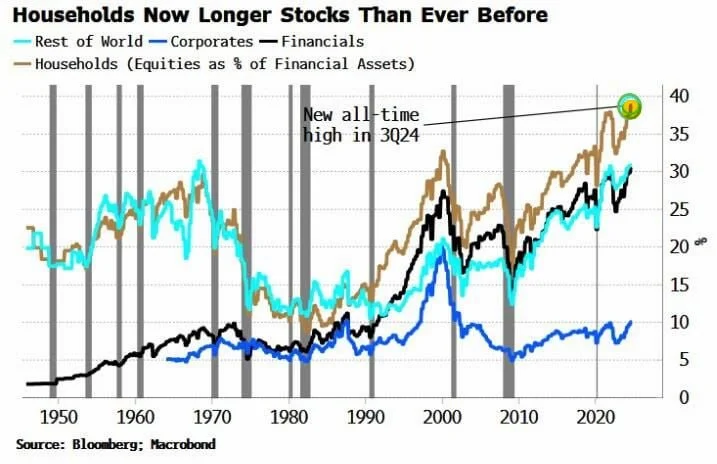

At the same time, U.S. households are more heavily invested in equities than ever before. The share of stocks within household financial assets has reached a new all-time high, underscoring how deeply market performance is now intertwined with household balance sheets.

This dynamic carries political implications as well. President Donald Trump has repeatedly highlighted record highs in the stock market, framing equity performance as a measure of economic success. He has also stated on multiple occasions that his administration intends to support financial markets and encourage further gains.

With U.S. households holding record exposure to equities, market performance increasingly affects voters directly. Sharp and prolonged drawdowns would not only impact portfolios, but also consumer confidence — a sensitive issue with midterm elections approaching.

For now, momentum remains firmly on the side of the bulls. Liquidity conditions, policy messaging and investor positioning continue to support higher prices. Yet as valuation metrics stretch further into uncharted territory, the margin for error narrows.

In short: markets may continue to rise, but they are doing so from levels that leave little room for disappointment — economic, political, or financial.

Olivia Carter

Olivia Carter