Long-Term Commodity Cycle Points Higher Into 2030, Analysts Say

Topdown Charts sees commodities in a long-term upcycle since 2020, potentially lasting to 2030, though energy and agricultural markets face near-term pressure.

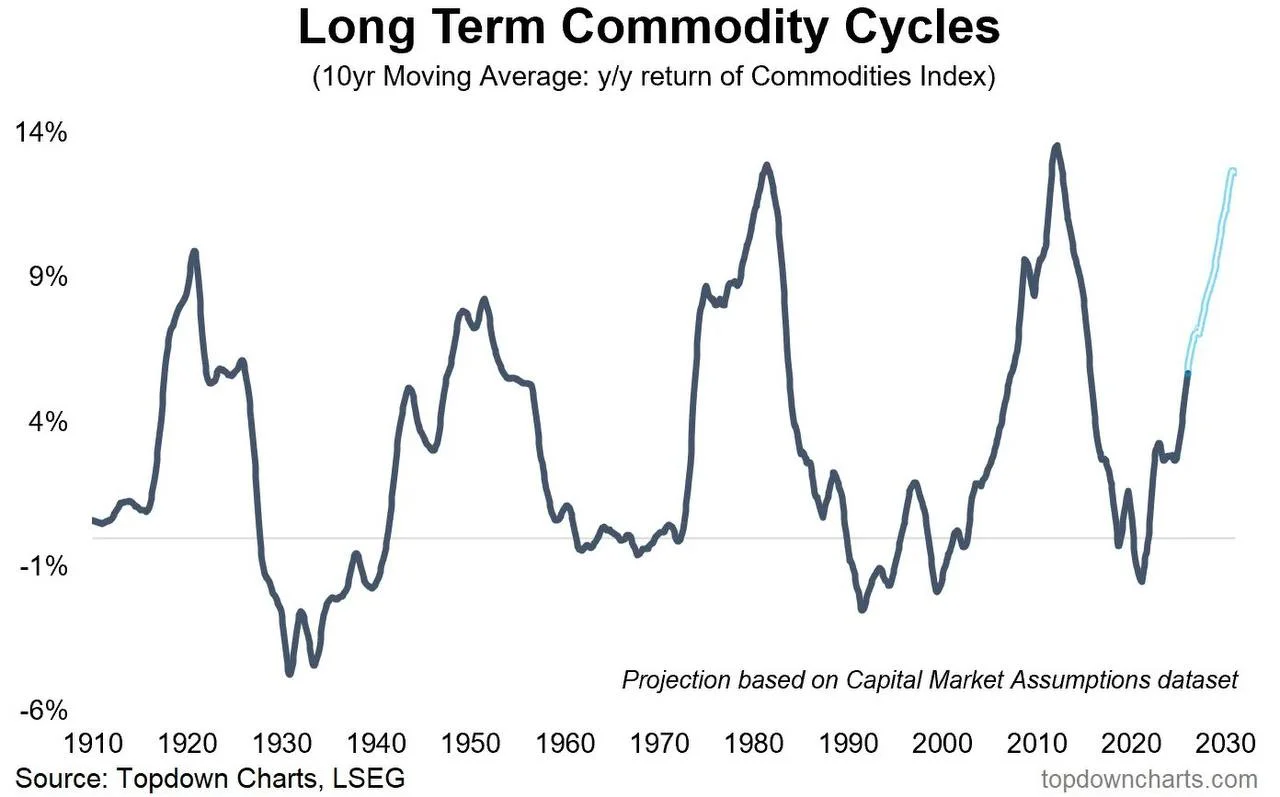

From an editorial perspective, the significance lies in the time horizon. According to long-term market analysis, the commodity market entered a structural upward cycle around 2020 — a phase that may extend until the end of the decade.

This assessment is based on historical commodity cycles, using long-term averages to smooth short-term volatility. As past cycles suggest, such multi-year phases often persist well beyond individual macro shocks or policy shifts.

However, the picture is far from uniform across the commodity complex.

Energy commodities and agricultural markets stand out as notable exceptions. Current-year outlooks for these segments remain weak, failing to confirm the broader long-cycle strength visible in aggregate commodity data.

At the same time, an increasingly rigid bearish consensus has formed around energy markets. From a market-mechanics standpoint, such positioning can be a warning sign. When expectations become overly one-sided, price action often moves against the majority, as markets tend to extract returns from consensus trades.

In practical terms, this creates a difficult environment for commodity-focused traders. Long-term signals point to structural support, while short-term fundamentals and sentiment continue to generate pressure in key sectors.

The takeaway is cautious rather than optimistic. If the long-cycle thesis holds, commodities remain within a broader upward phase. For now, however, traders should be prepared for another challenging year marked by dispersion, sharp rotations, and limited margin for error.

Olivia Carter

Olivia Carter