Copper Prices Rise as Chile’s Production Falls, Setting Up a 2026 Supply Squeeze

Copper prices are holding near long-term resistance as Chilean production declines, strengthening the case for a supply-driven rally into 2026.

Copper markets are showing early signs of a tightening supply-demand balance, as prices push higher while production in Chile — the world’s largest copper producer — continues to trend lower.

Prices press resistance

On long-term charts, copper prices are trading near a multi-decade resistance zone, with monthly candles showing persistent upside pressure. The structure suggests growing acceptance at higher levels rather than a speculative spike.

Chile production trends lower

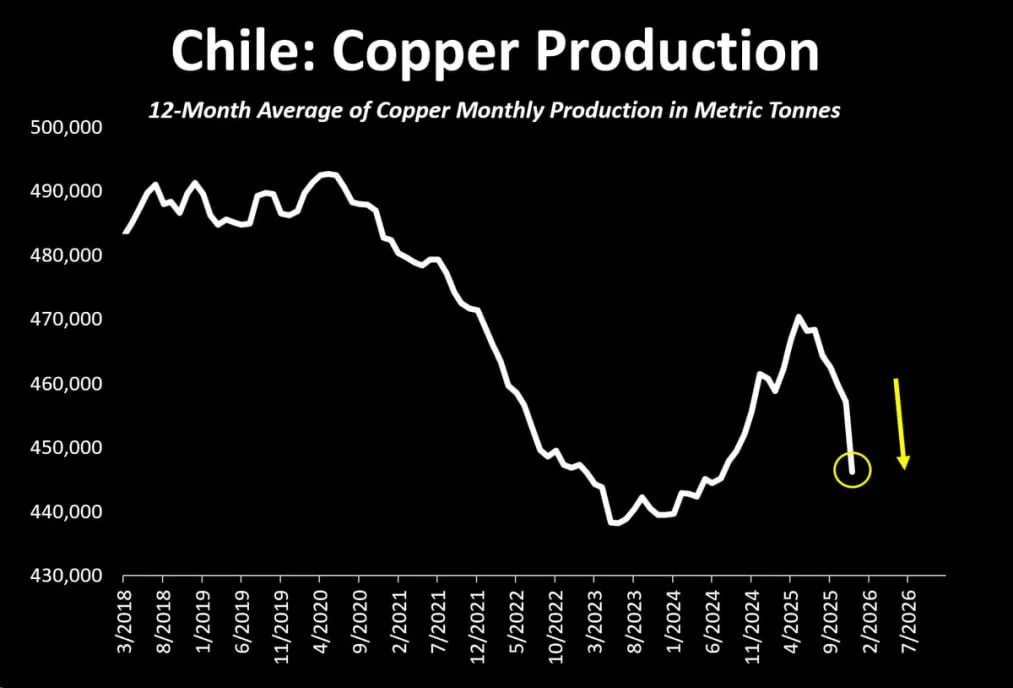

Chile, which accounts for roughly 25% of global copper production, has seen a sustained decline in output. The 12-month average of monthly copper production has rolled over sharply since 2020 and remains well below prior cycle peaks.

Recent data shows production struggling to recover, with fresh weakness emerging into late 2025 — a signal that supply constraints may be structural rather than cyclical.

Supply risks dominate the outlook

Declining ore grades, higher extraction costs, water constraints, and underinvestment in new large-scale projects continue to weigh on Chilean output. These factors limit the ability of supply to respond quickly to higher prices.

At the same time, demand expectations remain supported by electrification, grid expansion, EV penetration, and energy transition-related infrastructure.

2026 shaping up as a key year

According to analysts at Crescat Capital, copper could emerge as one of the most important macro commodities in 2026, driven by tightening physical supply and long-cycle underinvestment.

From a market perspective, the divergence between rising prices and falling production strengthens the case for a structural bull phase rather than a short-term trade.

Olivia Carter

Olivia Carter